Apple is developing a buy now, pay later (BNPL) service as part of its new iOS 16 operating system.

Apple Pay Later will allow users in the United States to divide the cost of a purchase into four payments over six weeks, with no interest or fees charged.

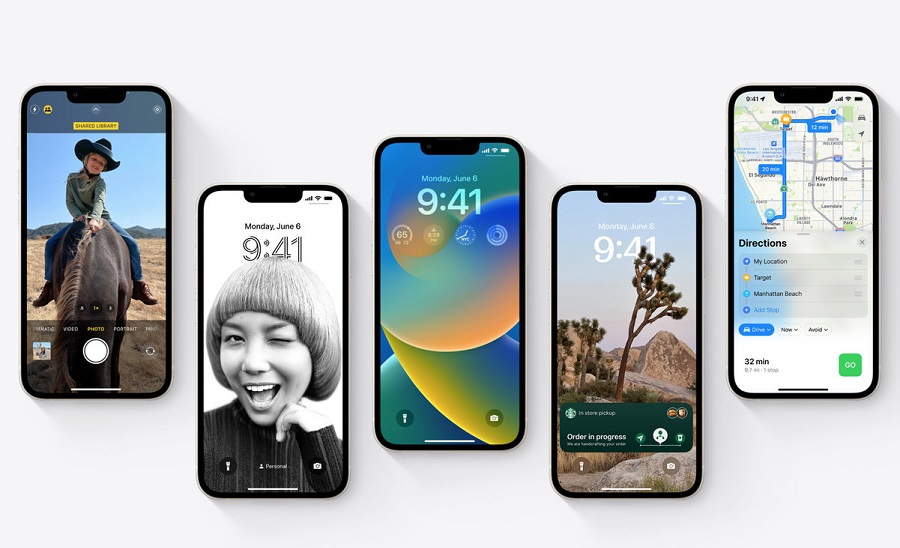

It is one of several new iPhone features, including the ability to edit iMessages and one designed to assist people in abusive relationships.

The features were announced at WWDC, Apple’s annual developer conference.

The way low-income people use BNPL services, which are currently unregulated in the UK, has been criticised.

In December 2021, Panorama reported that an estimated 15 million adults of all ages in the UK are actively using BNPL, with the main operators in the UK offering the service being Klarna, Clearpay, Laybuy, and PayPal.

Concerns have been raised about whether people are overly reliant on it, after Citizens Advice discovered in March that one in every twelve people uses BNPL services to cover essentials such as food and toiletries.

According to Citizens Advice, young people, people in debt, and people claiming Universal Credit were at least twice as likely as other groups to have used BNPL for these basic costs.

The new version of iOS 16, due to be released in the Autumn, will bring a range of additional features to the iPhone.