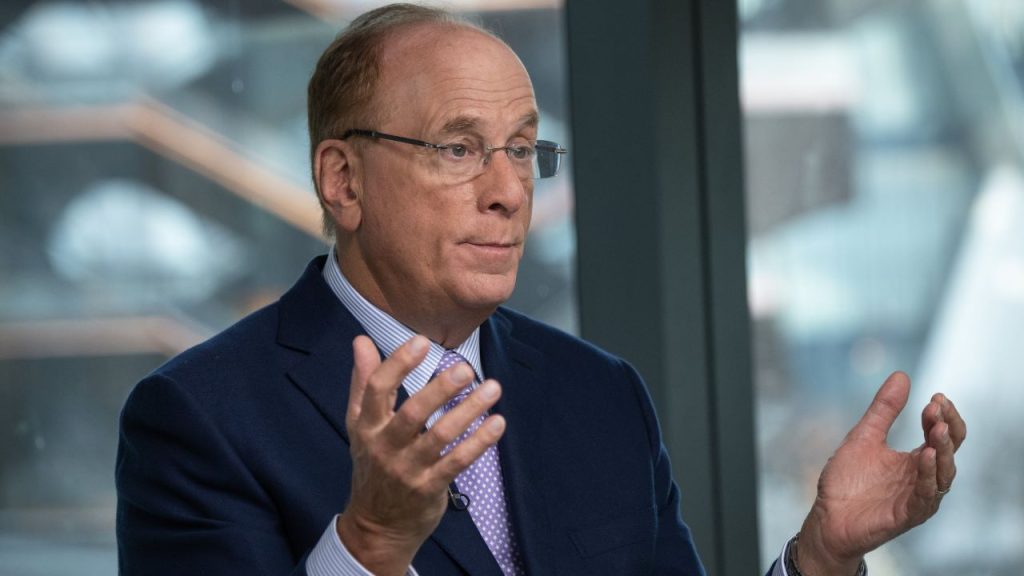

In the realm of finance, the incorporation of environmental, social, and governance (ESG) factors into investment strategies has become increasingly prevalent. However, this integration has sparked controversy and legal battles, as evidenced by Mississippi’s recent cease-and-desist order against BlackRock, the world’s largest money manager.

The cease-and-desist order issued by Mississippi Secretary of State Michael Watson accuses BlackRock of making fraudulent statements and misrepresentations regarding its ESG policies. Specifically, the order alleges that BlackRock has been “pushing” ESG factors on portfolio companies in a manner that could deceive investors. This move by Mississippi represents the latest development in a longstanding conflict between Republican-led states and BlackRock over ESG practices.

At the heart of the controversy lies the fundamental question of whether ESG considerations align with traditional investment objectives of maximizing shareholder value. Critics argue that ESG practices deviate from this objective and serve as a means to advance political agendas, particularly by indirectly “blacklisting” certain industries such as fossil fuels and firearms.

ESG proponents, on the other hand, view these considerations as essential for promoting sustainable and socially responsible investing. They argue that ESG integration can lead to better risk management, improved long-term financial performance, and positive societal impact. For investors increasingly concerned about issues such as climate change, diversity, and corporate governance, ESG offers a framework for aligning their financial goals with their values.

In response to the cease-and-desist order, BlackRock has defended its ESG approach, emphasizing its commitment to investing in accordance with clients’ best financial interests and applicable laws. The firm asserts that its primary objective is to maximize risk-adjusted returns for the funds its clients choose to invest in, rather than advancing a particular political agenda.

The legal battle between BlackRock and Mississippi underscores broader debates surrounding the role of finance in addressing societal challenges and advancing ethical principles. As the influence of ESG investing continues to grow, it is likely to face increased scrutiny and regulation, with implications for investors, corporations, and policymakers alike.

Moving forward, stakeholders must navigate the complex terrain of finance and values, seeking to strike a balance between financial returns and social impact. Transparency, accountability, and dialogue will be essential in fostering trust and ensuring that ESG practices serve the best interests of investors and society as a whole.

Ultimately, the BlackRock ESG controversy serves as a reminder of the evolving landscape of finance, where considerations of sustainability, ethics, and social responsibility are increasingly shaping investment decisions and reshaping the financial industry.