The battle between tech giants Advanced Micro Devices (AMD) and Nvidia (NVDA) in the semiconductor industry, particularly in artificial intelligence (AI), is crucial for shaping the future of AI-driven technologies. As AI applications continue to grow, the demand for powerful and efficient semiconductor chips tailored for AI workloads is increasing. Both companies are major players in providing high-performance computing solutions, making their rivalry significant for the future of AI technology. Investors closely monitor developments from both AMD and Nvidia as each seeks to gain a competitive edge in the rapidly evolving AI market.

AI is driving chip-market surge

According to a Deloitte study released in November, the market for specialized chips optimized for generative AI is projected to surpass $50 billion in 2024. This figure is a significant increase from close to zero in 2022 and is expected to represent two-thirds of all AI-chip sales in that year. Deloitte also forecasts that total AI-chip sales in 2024 will account for 11% of the predicted global chip market, which is estimated to be $576 billion. Recent forecasts for the AI chip market in 2027 vary from an aggressive estimate of $400 billion to a more conservative estimate of $110 billion, according to the firm.

Deloitte highlighted that major chip companies, along with others, are developing chips specifically optimized for generative AI. This is because older AI chips are deemed too slow or inefficient for this purpose and lack the necessary design and memory. While general-purpose chips like central processing units (CPUs) can handle simpler AI tasks, their usefulness is diminishing as AI technology progresses.

Investors are listening for chip advances

Wall Street is clearly receiving a resounding message. The S&P 500, already on track for one of its most impressive first-quarter rallies in decades, is expected to continue its upward trajectory over the next year, driven by the ongoing AI-led investment surge. Two key players in this rally are Advanced Micro Devices (AMD) and Nvidia.

Nvidia, the current leader in providing chips specifically designed for training and running AI applications, has experienced a significant surge in its stock price recently. On February 22, the company witnessed a remarkable stock surge that added over $277 billion to its market value, marking the largest single-day market gain in U.S. history. This surge also propelled the S&P 500 to achieve an all-time high of 5,087.03 points. Nvidia reported adjusted fourth-quarter earnings of $5.16 per share, a nearly sixfold increase from the same period the previous year, with revenue more than tripling to $21.1 billion. As of the latest update, the company boasts a staggering market capitalization of $2.134 trillion.

On the other hand, AMD reported fourth-quarter earnings of 77 cents per share on January 30, marking an 11.5% increase from the same period in the previous year, in line with Wall Street’s expectations. Revenue also saw a 10% rise to $6.17 billion, surpassing analysts’ forecasts of $6.12 billion.

AMD challenging Nvidia; analysts respond

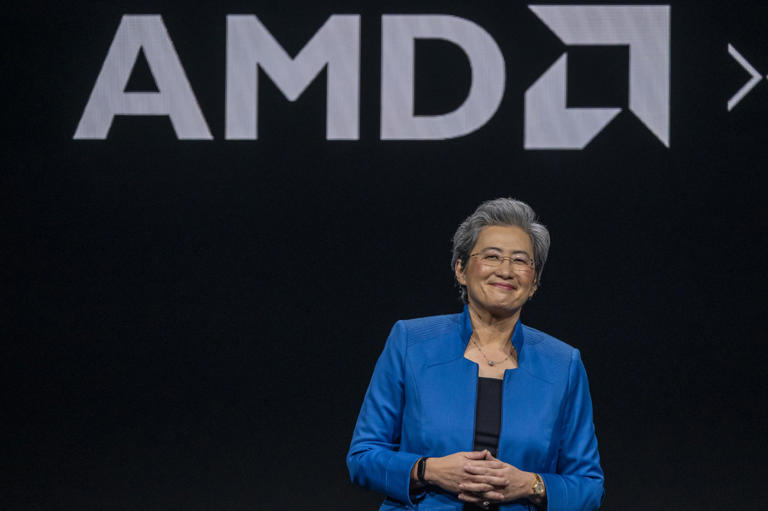

During AMD’s earnings call, CEO Lisa Su highlighted the company’s success in securing multiple contracts with major players across various industries such as finance, energy, automotive, retail, technology, and pharmaceuticals. These wins position AMD for continued growth, especially with expanded production deployments planned for 2024.

AMD’s latest product, the MI300X graphics-processing unit tailored for supporting generative artificial intelligence technologies, is anticipated to generate approximately $2 billion in sales over the next year. The company aims to leverage this new launch to compete against Nvidia’s offerings amidst the global surge in demand for AI-related technologies. Analysts in the industry believe that the MI300X could present a challenge to Nvidia’s dominant H100 graphics processing unit chip, particularly in the large language model AI market.

Purdy Ho, an analyst at Huatai Research, expressed confidence in AMD’s MI300, stating that it is one of the most competitive products positioned to challenge Nvidia.

Furthermore, on March 4, Barclays analyst Tom O’Malley raised the firm’s price target on AMD to $235 from $200 while reiterating an overweight rating on the shares. O’Malley noted that shipments of client microprocessor units (MPUs) exceeded expectations in December but are now undergoing a meaningful reset in March. Despite this, Barclays foresees mid-single-digit growth in client MPUs for the full year, along with mid-single-digit declines in servers. AMD is expected to continue gaining market share in both segments, with projections indicating an increase from 25% in the fourth quarter of 2023 to 27% throughout 2024.