Nvidia, a leading player in the semiconductor industry, witnessed a surge in its stock price following a robust profit forecast from Samsung Electronics. The South Korean tech giant’s anticipation of a tenfold increase in first-quarter operating profit has bolstered investor confidence in the demand for artificial intelligence (AI) chips. This article explores the implications of Samsung’s optimistic outlook for Nvidia and the broader chip sector, highlighting the significance of memory chips in AI accelerators and the potential collaboration between Samsung and Nvidia.

Samsung’s Profit Forecast: Samsung Electronics’ projection of a tenfold increase in first-quarter operating profit has sent positive ripples through the semiconductor market. While the company attributed this growth primarily to its memory-chip business, analysts anticipate that the demand for AI chips will also play a significant role in driving profits. The stellar performance of U.S. peer Micron Technology further validates the optimistic outlook for the semiconductor industry, indicating a favorable environment for companies with exposure to AI and consumer electronics.

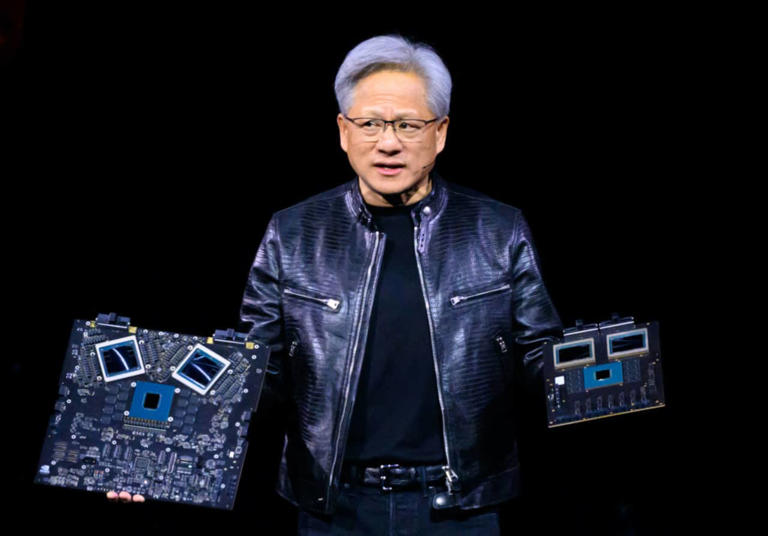

Memory Chips in AI Accelerators: Memory chips have emerged as a critical component of AI accelerators, facilitating the processing and storage of vast amounts of data required for AI applications. Samsung’s development of high bandwidth memory (HBM) chips, particularly the HBM3E 12H, underscores its commitment to innovation in this space. Reports suggesting that Nvidia may incorporate Samsung’s HBM chips into its graphics processing units (GPUs) have fueled speculation about potential collaboration between the two tech giants. Mass production of HBM3E 12H chips is expected in the first half of the year, opening doors for enhanced performance and efficiency in AI-driven technologies.

Impact on Semiconductor Companies: The positive outlook for semiconductor companies, particularly those heavily involved in AI and consumer electronics, bodes well for the industry’s growth trajectory. Independent analyst Richard Windsor highlighted the favorable prospects for companies exposed to AI, citing Samsung’s earnings report and Micron’s strong performance as indicators of a promising year ahead. While Nvidia stands out as a frontrunner in the AI chip market, competitors like Advanced Micro Devices (AMD) and Intel also stand to benefit from the anticipated surge in demand. Despite fluctuations in stock prices, the overall sentiment remains bullish, reflecting investor confidence in the long-term prospects of the semiconductor sector.

Market Performance and Investor Sentiment: Nvidia’s shares have experienced a remarkable ascent this year, outperforming major stock market indices such as the S&P 500 and the Nasdaq Composite. The company’s leadership in AI technology and its strategic partnerships have positioned it favorably to capitalize on growing demand for AI chips. While fluctuations in stock prices are inevitable, Nvidia’s strong performance underscores its resilience and potential for sustained growth in the dynamic semiconductor market. Investors remain optimistic about Nvidia’s future prospects, buoyed by favorable industry trends and technological advancements.

Samsung Electronics’ optimistic profit forecast has provided a significant boost to Nvidia and the semiconductor industry at large. The anticipated surge in demand for AI chips, coupled with advancements in memory chip technology, underscores the transformative potential of semiconductor innovations. As companies like Nvidia continue to drive innovation and expand their product offerings, they are poised to play a pivotal role in shaping the future of AI-driven technologies. With strong market fundamentals and favorable industry dynamics, the semiconductor sector remains a compelling investment opportunity for investors seeking exposure to cutting-edge technology and sustained growth.