Matt Twork was intrigued by the Tesla Model 3’s range and cheap energy prices when he purchased one in June.

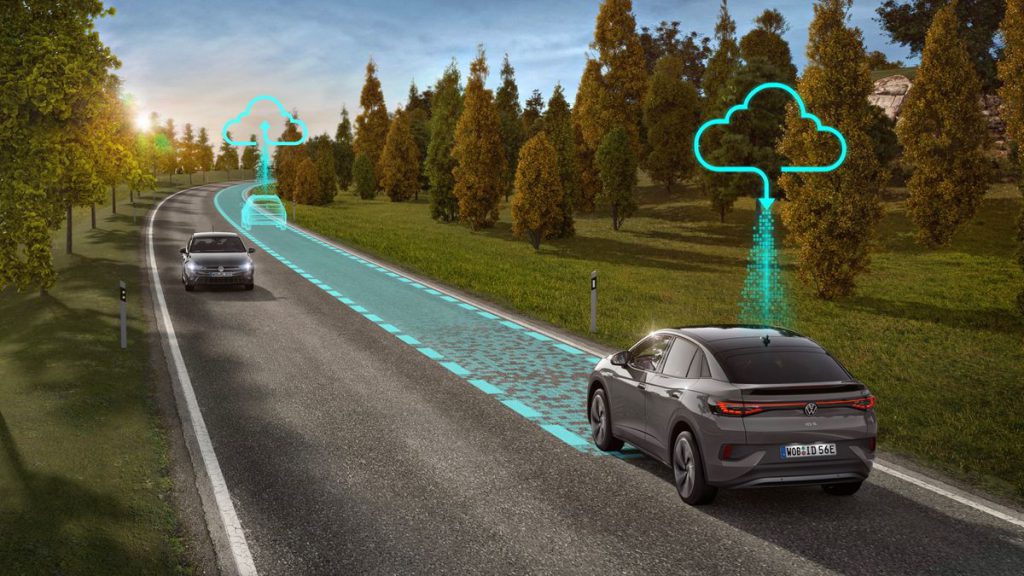

Automobiles have been quietly transforming into computers on wheels for years, with dozens of onboard microprocessors controlling everything from the drivetrain to entertainment and information systems. The software that controls that technology may be updated or replaced remotely via smartphone-style over-the-air updates, allowing automakers to repair faults, add substantially more advanced capabilities, and whole new features that weren’t accessible when the car was first introduced.

Manufacturers’ ability to remotely address issues and improve operation might put an end to one of their biggest headaches: malfunctioning electronic systems like voice control, navigation, and infotainment that irritate customers.

However, automakers’ ability to transform their goods into mobile ATMs that spit out money for updates and additions for the life of the car could be the bigger return.

GM CEO Mary Barra stated last month at an investor conference that internal corporate research showed that motorists are willing to spend an average of $135 per month on onboard software, subscriptions, and services, as well as the requisite hardware.

“Automakers will either have to change customer behavior, which we know is difficult, or they will have to come up with features that are much more valuable,” says the author.

BMW abandoned the concept after discovering that customers were unwilling to pay a proposed monthly subscription to use vehicle seat heaters. After receiving substantial public outrage, Toyota backed out of a plan to charge customers $8 per month or $80 per year to utilize their remote vehicle start technology.

Despite these reservations, industry observers believe that the market for onboard software and services is fast expanding, and not just in consumer vehicles. There will be a sizable market for fleet operators who want to track their cars’ position and check their condition in order to schedule service before there’s a breakdown.