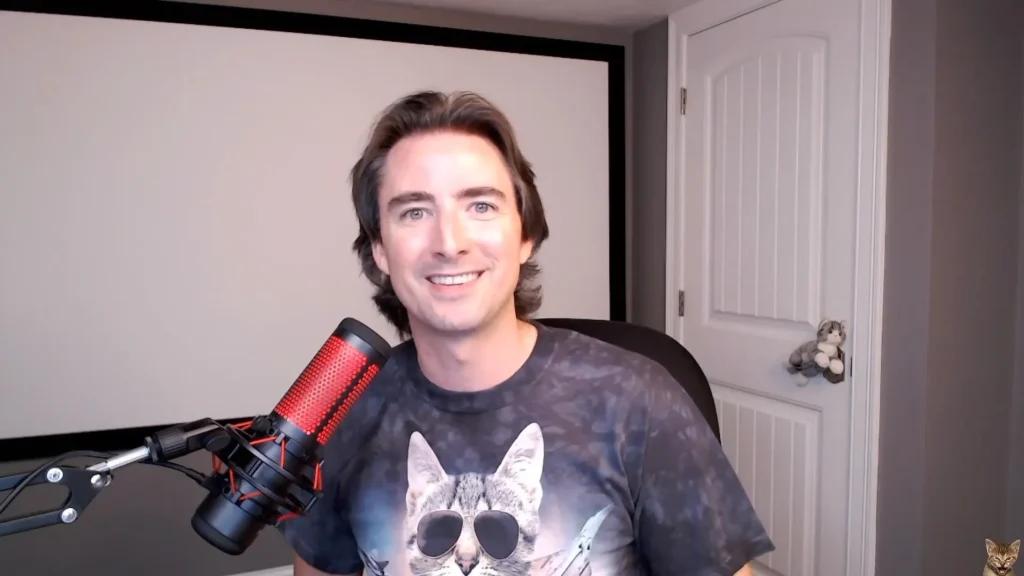

Keith Gill, known as ‘Roaring Kitty’ and a central figure in the 2021 GameStop saga, is facing a lawsuit filed by investors accusing him of securities fraud through a “pump-and-dump” An extensive examination of the case and its possible ramifications is provided below:The laws

The lawsuit is historical context

Keith Gill is accused of manipulating GameStop’s stock between May 13 and June 13 by secretly acquiring sizable amounts of stock and call options, according to the lawsuit, which was filed in federal court in Brooklyn. According to investors, Gill’s actions artificially inflated GameStop’s share price, causing extreme volatility and significant losses for the investors while he allegedly made a tidy profit for himself.

Claims of Financial Fraud

1. Pump-and-Dump Scheme: The core accusation against Gill is that he orchestrated a pump-and-dump scheme. This involves hyping up a stock’s value through misleading or false statements (pumping), and then selling off holdings at the inflated price (dumping), leaving other investors holding devalued securities.

2. Timing and Effect: The lawsuit draws attention to Gill’s sway over social media sentiment and his capacity to influence market sentiment. It refers to a particular instance in which GameStop’s stock price experienced a notable increase in tandem with Gill’s cryptic social media meme, and then experienced a sharp decline shortly thereafter.

3. Profitable Ventures: The complaint states that Gill’s actions allegedly brought in “millions of dollars” for him, using his social media following and celebrity status to influence the market to his advantage.

Legal and Commercial Consequences

1. Class Action Status: A group of investors alleging losses from Gill’s purported market manipulation are being represented by the lawsuit. If class action status is granted, it may include a wide range of impacted parties suing for damages.

2. Regulatory Scrutiny: Gill’s case may bring back questions about how online communities and social media influencers affect stock market volatility. Regulators might be prompted to review their guidelines regarding market manipulation and the obligations of those who have substantial control over retail investors.

3. Financial and Reputation Risks: In addition to monetary fines, Gill also runs the risk of having his career and reputation damaged. The lawsuit is verdict may have an effect on his ability to interact with investors on social media and his future participation in the financial markets.

Additional Consequences for Market Integrity

In a time when social media and online forums can magnify market movements, the “Roaring Kitty” lawsuit highlights more general worries about investor protection and market integrity. It calls into question whether current regulations are sufficient to combat new forms of market manipulation as well as the obligations of those with significant influence over ordinary investors.

The lawsuit against Keith Gill is a central topic of discussion for discussions about accountability, transparency, and the changing securities law environment in the digital age as he works through the upcoming legal challenges. The decision will probably have an impact on influencer obligations and regulatory strategies for online trading platforms. It may also establish precedents that affect similar cases involving claims of market manipulation in the future.

Even though the Keith Gill (also known as “Roaring Kitty”) lawsuit is still in progress, its effects may have a lasting impact on the financial sector, affecting regulatory frameworks and investor confidence in the markets.