On Monday, Asian shares soared to their highest levels in two years, riding on the wave of optimism fueled by expectations of imminent interest rate cuts and China’s proactive measures to stabilize its ailing property market. Concurrently, the prices of commodities such as copper and gold surged to unprecedented heights as investors sought refuge amid geopolitical uncertainties and inflationary concerns.

The surge in Brent crude futures to a one-week high of $84.25 per barrel was precipitated by news of a helicopter crash that claimed the life of Iran’s president and reports suggesting health issues for the Saudi Arabian king. These developments sparked apprehensions about potential instability in the already volatile Middle East region, prompting a rally in crude oil prices.

Gold prices experienced a notable uptick of over 1% to reach $2,449.89, while copper futures witnessed a remarkable surge of nearly 7% in Shanghai, hitting a record high of 88,940 yuan per tonne, and reaching $11,104.50 in London. The robust performance of copper prices was underpinned by supply constraints and signs of resilience in global economic growth. Meanwhile, record first-quarter gold imports into China provided strong support for gold prices.

In the realm of equities, MSCI’s broadest index of Asia-Pacific shares outside Japan saw a notable uptick of 0.4%, with Japan’s Nikkei climbing 0.7% to reach a five-week high. Additionally, S&P 500 futures, FTSE futures, and European futures all posted marginal gains of 0.1%.

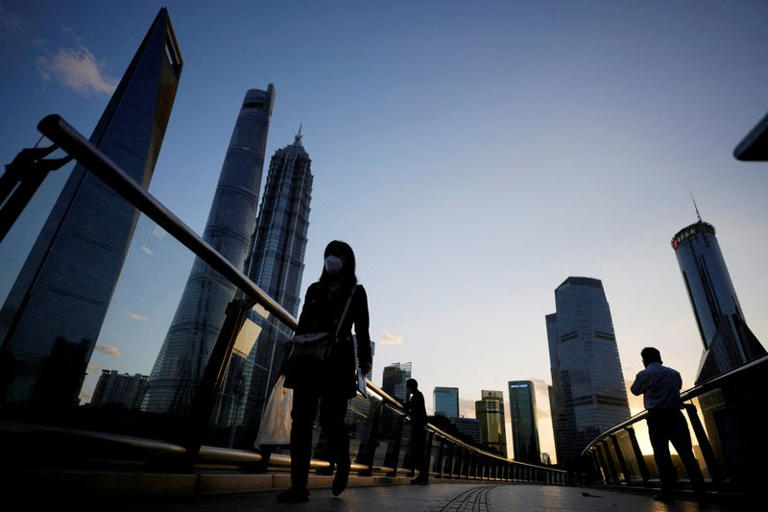

China’s announcement of sweeping measures to stabilize its property sector, including additional funding facilitated by the central bank and local government intervention in purchasing apartments, underscored the government’s commitment to addressing concerns about the stability of the property market. Despite leaving benchmark rates unchanged, these measures aimed to assuage investor apprehensions and bolster confidence in the Chinese economy.

Investor attention turned to upcoming policy speeches, meeting minutes, and central bank decisions in New Zealand, along with Nvidia’s earnings results. Expectations for potential rate cuts by the Federal Reserve remained elevated following recent economic data releases and policymakers’ dovish signals.

In the bond markets, two-year U.S. Treasury yields remained steady, while ten-year yields in Japan surged to their highest level since 2013 amid growing speculation of potential rate hikes by the Bank of Japan.

Currency markets saw the U.S. dollar registering its largest weekly drop against the euro in two-and-a-half months but stabilizing in Asian trading. The euro strengthened marginally to $1.0880, while the yen held steady at 155.70 per dollar.

Commodity markets witnessed unrest in New Caledonia driving nickel prices higher, while silver followed the upward trajectory of gold, surpassing the $30 mark.

As markets awaited central bank meeting minutes and flash global PMI data later in the week, investors remained vigilant amid lingering geopolitical tensions and uncertainty surrounding monetary policy decisions.