You might have heard the popular story about how Starbucks has more cash reserves than some banks. You might also know that Amazon and Uber process more than a million transactions each, every day.

By virtue of being close to a consumer’s money, marketplaces also are close to opportunities. And technology is what turns that opportunity into more money. Amazon India now offers lending and payments, Starbucks has cards, and Uber is now offering financial services to its drivers.

Open finance, and embedded finance are the two core technologies that are making it seamless for every business to become a fintech company. Both the technologies are fairly new on the timeline of global financial technologies, and even more recent in the Indian context.

We got in touch with Kumar Srivatsan, who has seen more than a decade of the amalgamation of finance and technology, and believes that it is finally time for every company to be a fintech company.

Kumar is the Founder and CEO of Fego and a member of the Technology Service Provider (TSP) steering committee at Sahamati.

In this article, we distil our conversation with Kumar to understand the two core technologies leading to the fintech revolution, and understand why digital marketplaces should be the first to become a fintech business.

Why is this change happening now – Open finance

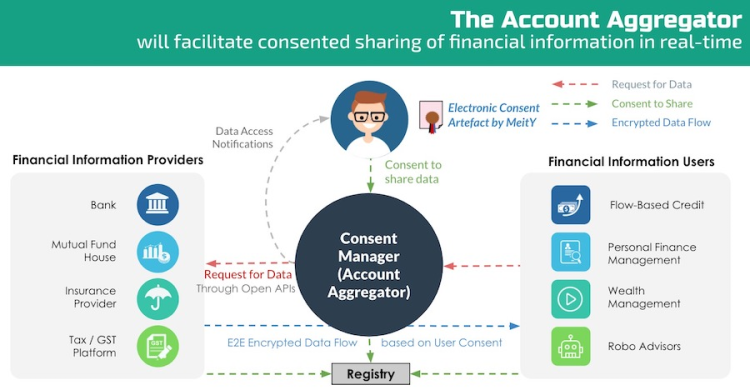

Why isn’t every company already a fintech company? Because there was no infrastructure available till recently. That has changed with the Account Aggregator (AA) framework in India, which allows for consent-based, digital, and real-time access to a consumer’s financial data. AA is the foundation on which open finance will be built in India.

We will hold back on the details, there are too many. The image below is sourced from Sahamati’s official website, and explains what AA technically unlocks.

Data sharing with Account aggregator framework in India [source]

Getting real-time access to transaction data from consumers seems like a simple idea, but this has been inaccessible and unreal for ages. AA changes that – It allows businesses to seek digital consent from consumers, and upon approval, access financial profiles.

Essentially, your consent to access your financial data for a meaningful purpose will let any entity build powerful financial products and services. From easier onboarding for bank accounts to accessible credit, engaging financial experiences and personalised recommendations – AA enables it all.

The image below is a very limited view of businesses and initiatives that AA has enabled already, we can bet you are somehow associated to at least a few of them:

Participants in the Account Aggregator framework [source]

How will this change propagate in the market – Embedded finance

The adoption curve of open finance in India is a hockey stick – Massive magnitudes of budgets and investments have been earmarked for experiments with open finance by companies and funds of all sizes.

But the barrier to entry exists – Right from knowing the framework to building solutions on top of it, and of course the compliance overheads. Given enough time, say a decade, almost every company would be able to build a fintech solution on their own.

Is there a way for the market, which is hungry to experiment with open finance, to reduce the barrier and access the opportunity faster? Yes, with embedded finance.

Embedded technologies are not new to us, it’s the exact same technology that has been making our washing machines and ovens smarter. Embed a programmed chip into an otherwise mechanical machine, and make it interactive.

In the same way, embed an open finance solution into an otherwise non-fintech company, and make it talk money to consumers. The idea behind embedded finance is to wrap the competency, engineering, and compliance overheads into a single solution, and plug it into a potential opportunity. Here is an example of how Fego wraps everything needed to build engaging personal finance experiences into an API or SDK for developers to plug into their app and kickstart a fintech initiative.

[source]

The buy-now-pay-later at checkout, the prepaid wallet in your favourite food delivery app, they are all a manifestation of embedded finance.

Marketplaces – Already close to many wallets

Marketplaces make at least two stakeholders think about money – Buyer, and seller. It’s a source of income for one and responsible for an expense in the bank statement for another. This fact alone provides a ton of opportunities for marketplaces to experiment with embedded finance. Here is a limited view on what the map of opportunities looks like:

Here are some strong pillars to support the business case for marketplaces:

- Improvements in core business areas: Payments exist on both sides of the marketplace, appending credit lines will directly impact core business areas like inventory, AOV, Transaction frequency/volume etc.

- Stronger matchmaking, higher conversions: Real-time intelligence from either side will improve the matchmaking algorithms in a marketplace to produce significantly higher conversions.

- New revenue, low friction: With embedded finance making barriers to entry and overall deployment cost significantly lower, the revenue (and hence return on investment) for new products is a great compliment to marketplace revenue.

- New product, pre-built distribution: Successful marketplaces have a robust distribution already built out. Financial products are a great way to leverage existing reach for high-value and long-term engagements with consumers.

- Retention strategy: Marketplaces, especially in India, struggle with repeat purchases. New products like personal finance tools etc. are a better way than unsustainable discounts and incentives to increase retention and drive loyalty to the marketplace.

Amazon, Swiggy, and Zomato, along with some other large players, are already coming closer to consumer’s finances with payments, credit, and personal finance features inside the app.

With technology making it easier for everyone else in the market as well, It will be intriguing to see which marketplaces make the first move, and how open finance and its applications will react with India’s marketplace entropy.