The 10-year Treasury yield has recently dropped to a pivotal level, currently hovering around 4.3%, down from its high of about 4.7% earlier this year. This decline is driven by a combination of slowing economic growth and easing inflationary pressures, making bond returns more attractive and consequently pushing bond prices up and yields down. If this downward trend in yields continues, it could have significant implications for the stock market, particularly benefiting certain types of stocks.

Historically, a lower 10-year Treasury yield signals a shift in investor sentiment, indicating expectations of lower inflation and slower economic growth. This is reinforced by the Federal Reserve’s commitment to maintaining high short-term interest rates to curb inflation, putting further pressure on long-term growth and inflation. As a result, long-dated yields like the 10-year Treasury could continue to fall. Katie Stockton, founder of Fairlead Strategies, supports this view, suggesting that long-term indicators point to a cyclical decline in yields.

In this environment, certain stocks are poised to benefit more than others. High-growth companies, in particular, stand to gain. These firms, often valued based on the future earnings they are expected to generate, see their valuations improve as lower long-term bond yields make their future profits more valuable in present terms. This scenario typically benefits the technology sector, which is home to many high-growth companies. For example, software giants like Microsoft, Salesforce, and Adobe are rapidly expanding their customer bases and integrating artificial intelligence into their products, driving faster-than-average growth in sales and profits.

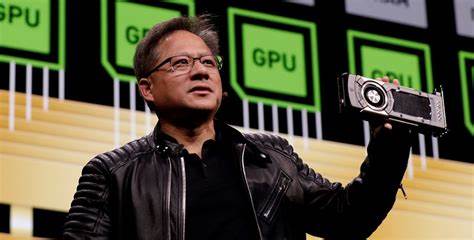

Chip manufacturers such as Nvidia and Advanced Micro Devices also fall into this category. They are expected to see increased chip sales to data centers to support AI applications, contributing to their robust growth prospects. These companies, due to their significant future earnings potential, become more attractive investments as long-term bond yields fall.

Beyond the tech sector, companies like Eli Lilly represent another example of a high-growth firm benefiting from lower yields. Eli Lilly’s successful push into the obesity treatment market, with drugs like Mounjaro and Zepbound, is expected to drive substantial revenue growth. Analysts predict that sales of these drugs could more than double this year and reach about $60 billion by 2029, driving nearly 12% annual revenue growth over the next six years. This growth, coupled with relatively stable spending, should result in expanding profit margins and nearly 20% annual earnings growth, making Eli Lilly a promising investment in a low-yield environment.

In addition to high-growth stocks, high-quality, non-cyclical stocks with strong dividend yields are also likely to benefit from lower Treasury yields. The Invesco S&P 500 Low Volatility exchange-traded fund (ETF) is an example, featuring companies like Coca-Cola, Walmart, Colgate-Palmolive, Procter & Gamble, and Johnson & Johnson. These companies are less sensitive to economic cycles and provide steady cash flows, making them attractive for their reliable dividend payments. As Treasury yields drop, the relatively higher yields from these dividend-paying stocks become more attractive, potentially driving up their prices.

Victor Cossel, a macro strategist at Seaport Research Partners, notes that higher-quality and higher-growth names in the S&P 500 have already outperformed riskier stocks as yields have declined. This trend suggests that investors expecting further declines in yields should consider investing in high-quality and high-growth stocks to capitalize on this shift.

In summary, the recent drop in the 10-year Treasury yield to around 4.3% and the potential for further declines could significantly benefit high-growth and high-quality stocks. Investors looking to navigate this changing landscape should focus on companies with strong future earnings potential and those that offer reliable dividend payments, as these stocks are likely to outperform in a lower-yield environment.