On Friday, the Japanese yen managed to stabilize near a 12-week high against the U.S. dollar, reflecting a period of relative calm following a significant downturn in global equity markets. This stabilization comes as markets across the Asia-Pacific region began to recover from a sharp sell-off the previous day. The MSCI index, which provides a broad measure of Asia-Pacific equities, showed a marginal decrease of 0.06% on Friday. This follows a more substantial drop of 1.88% the day before, indicating a cautious but notable rebound.

1. Regional Market Movements:

- Taiwan: Taiwan’s stock market, which had been closed for two days due to a typhoon, saw a dramatic decline of 3.53% upon reopening. This decline was partly a catch-up effect from the global market downturn experienced earlier in the week. Taiwan’s tech-heavy equity index, in particular, mirrored broader global trends.

- Japan: In Japan, the Nikkei index experienced a slight decline of 0.12% after initially showing some gains. Despite the minor drop, the Nikkei’s performance reflects broader regional trends and market sentiment.

- Australia: Australia’s benchmark index displayed a more positive trend, rising by 0.79%. This increase suggests a recovery from previous market pressures and highlights a more resilient performance compared to other regional markets.

- South Korea: The Kospi index in South Korea saw an increase of 0.89%, indicating a strong rebound and contributing to the overall positive sentiment in the region.

- Hong Kong and Mainland China: The Hang Seng index in Hong Kong rose by 0.21%, while mainland Chinese blue-chip stocks remained relatively stable, showing minimal movement. This reflects a balanced performance amid broader market fluctuations.

2. U.S. and European Market Indicators:

- U.S. Stock Futures: In the United States, stock futures showed signs of recovery after two days of declines in cash indexes. The S&P 500 futures rose by 0.43%, and Nasdaq futures advanced by 0.53%, suggesting a rebound in investor sentiment.

- European Markets: Pan-European Stoxx 50 futures increased by 0.17%, reflecting a moderate recovery in European equities following global market trends.

Economic Data and Market Reactions

1. U.S. Economic Data:

Recent economic data from the U.S. provided a boost to market sentiment. The data revealed stronger-than-expected economic growth for the second quarter and a cooling of inflation rates. This has helped to allay fears of an abrupt end to the economic expansion and has supported expectations for a Federal Reserve interest rate cut in September. The positive economic indicators have also contributed to a more optimistic outlook for the U.S. economy.

2. Upcoming Economic Indicators:

The focus now shifts to the release of the Personal Consumption Expenditures (PCE) deflator, a key inflation gauge favored by the Federal Reserve. This data is expected to play a critical role in shaping market expectations and sentiment. Kyle Rodda, a senior market analyst at Capital.com, emphasized that any significant upside surprise in the PCE Index could impact the anticipated timing and scale of Federal Reserve rate cuts. Such a development could potentially unsettle markets already grappling with cautious sentiment.

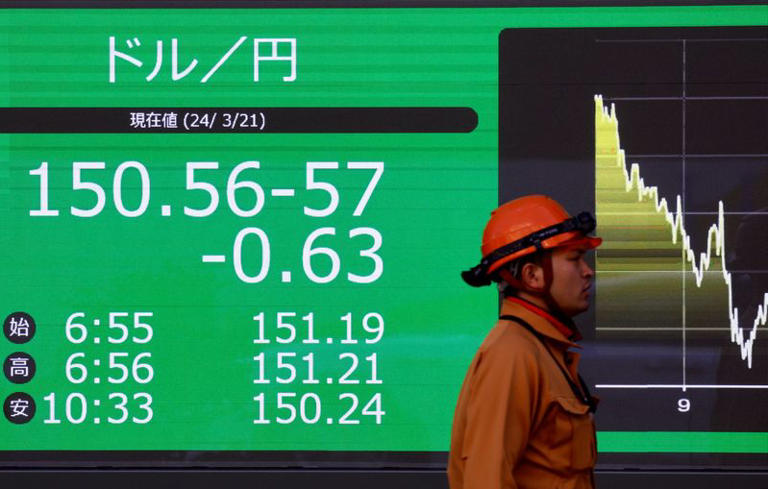

Yen and Currency Market Developments

1. Yen Performance:

The yen has appreciated approximately 2.5% against the dollar this week, marking its strongest performance since late April. On Friday, the dollar was trading 0.19% lower at 153.67 yen, after having dipped to 151.945 yen the previous day. The yen’s gains are attributed to reduced safe-haven demand and the unwinding of long-held bearish bets against the Japanese currency.

2. Market Expectations:

Analysts suggest that the support level for the yen between 152 and 151.80 yen could hold steady, with potential for the currency to rise towards 155.30 yen before the upcoming Bank of Japan (BOJ) policy meeting. The BOJ, along with the Federal Reserve, will announce their policy decisions on July 31. The rate futures market now indicates a 67.2% probability of a 10 basis point rate hike by the BOJ, up from 40% earlier in the week. Conversely, while there is a slight chance for a Fed rate cut next week, markets are more confidently pricing in a reduction in September.

U.S. Treasury Yields and Oil Prices

1. U.S. Treasury Yields:

U.S. Treasury yields exhibited some fluctuations during Asian trading hours. The two-year Treasury yields eased slightly to 4.4348%, though this was above the overnight low of 4.34%, a level not seen since early February. Meanwhile, the 10-year yield experienced a slight decline to 4.2445%, reflecting ongoing adjustments in the bond market.

2. Oil Prices:

Oil prices saw a modest increase, driven by stronger-than-expected U.S. economic data that raised expectations for higher crude demand. Brent crude futures for September rose by 12 cents to $82.49 per barrel, while U.S. West Texas Intermediate (WTI) crude for September increased by 13 cents to $78.41 per barrel. This uptick in oil prices reflects a rebound in market sentiment and expectations of increased consumption from the world’s largest energy consumer.

In summary, while Asia-Pacific equity markets showed signs of recovery from recent declines, the yen’s stabilization and the movements in global financial indicators highlight ongoing economic uncertainties and adjustments. The upcoming policy decisions by the BOJ and the Federal Reserve, along with key economic data releases, will be crucial in shaping future market trends and economic conditions.