The Federal Reserve is widely anticipated to keep its key interest rate unchanged at its current 23-year-high level during its upcoming policy meeting on Wednesday. This expectation reflects the central bank’s cautious approach in light of recent economic data. Although inflation has moderated in the second quarter and the job market has shown signs of softening, the Fed is likely to hold off on any immediate rate cuts.

Market participants are increasingly anticipating that the Fed will begin cutting the federal funds rate starting in September. They will be closely watching for any indications from the Fed next week about the timing of these potential cuts. While lower interest rates could be on the horizon, they are not expected to materialize immediately.

The Fed’s decision to keep rates steady next Wednesday is influenced by several factors. Despite some economists advocating for a rate cut in July, financial market participants have assigned only a 4.7% probability to this outcome, according to the CME Group’s FedWatch tool, which forecasts rate movements based on fed funds futures trading data. This tool reflects a cautious market sentiment, as many believe that a decision on rate cuts may be premature at this stage.

Inflation, which had initially surged in the first quarter of the year, has been on a downward trajectory recently. A Friday report on the Fed’s preferred measure of inflation, the Personal Consumption Expenditures (PCE) price index, showed continued easing. Despite this positive trend, some economists argue that the Fed should hold off on rate cuts until it is certain that inflation will not rebound. They suggest that the central bank might use the upcoming meeting to assess whether inflation is firmly under control or if further action is needed.

Economic growth has been slowing, and unemployment has been ticking up, making the economy more vulnerable to external shocks. Moody’s Analytics Economist Justin Begley highlights that keeping rates high for too long could negatively impact the labor market and dampen business and consumer confidence. Such developments could be detrimental to personal income and overall economic stability.

In recent speeches, Fed officials have expressed cautious optimism about the progress made in reducing inflation but have indicated that more data is needed before making any definitive moves on rate cuts. Michael Gapen, chief U.S. economist at Bank of America Securities, expects the Fed to keep the policy rate unchanged in July while signaling progress on inflation. He believes that while the Fed is optimistic about the possibility of cuts in the near term, it will likely avoid committing to a specific timeline for September without further data.

Should the Fed decide to maintain the current rate on Wednesday, the September meeting could become a critical juncture in its monetary policy strategy. A decision to cut rates in September would mark the first reduction since the onset of the pandemic in 2020. During the pandemic, the Fed lowered rates to near zero to support economic activity with easy money. However, starting in March 2022, the Fed began increasing rates to combat rising inflation. The most recent rate hike in July 2023 brought the fed funds rate to its highest level since 2001.

Over the past two years, inflation, as measured by the PCE price index, has decreased from a peak of 7.1% to around 2.5%, nearing the Fed’s target of 2%. Meanwhile, the previously robust labor market has softened, with the unemployment rate rising to 4.1% from a historic low of 3.4% reached last year.

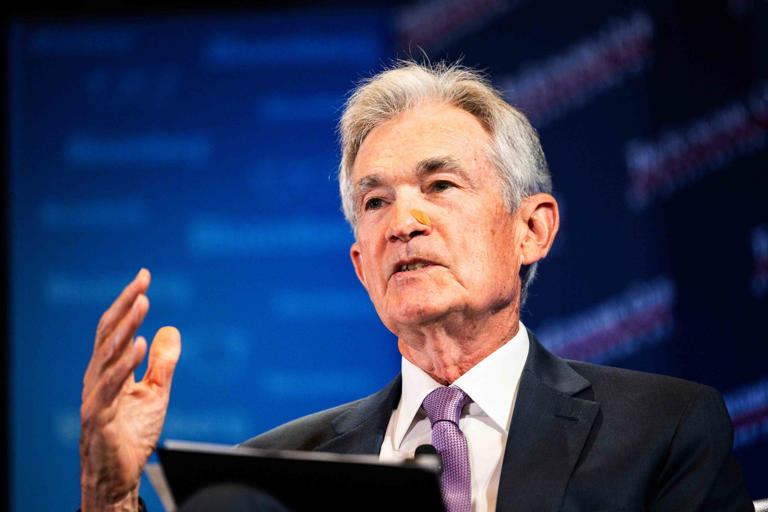

Fed Chair Jerome Powell has expressed concern about both inflation and the labor market, suggesting that the central bank might soon shift its focus away from solely combating inflation to addressing broader economic conditions. The Fed’s dual mandate involves managing inflation while supporting maximum employment, and its policy decisions will continue to reflect this balance as it navigates the evolving economic landscape.