As global economic landscapes shift, attention turns to critical decisions by major central banks, each grappling with unique challenges. The U.S. Federal Reserve, the Bank of England, and the Bank of Japan are set to make pivotal announcements, potentially shaping market dynamics and economic forecasts. This week’s economic data releases will also provide crucial insights into the health of various economies worldwide, influencing future policy directions.

United States

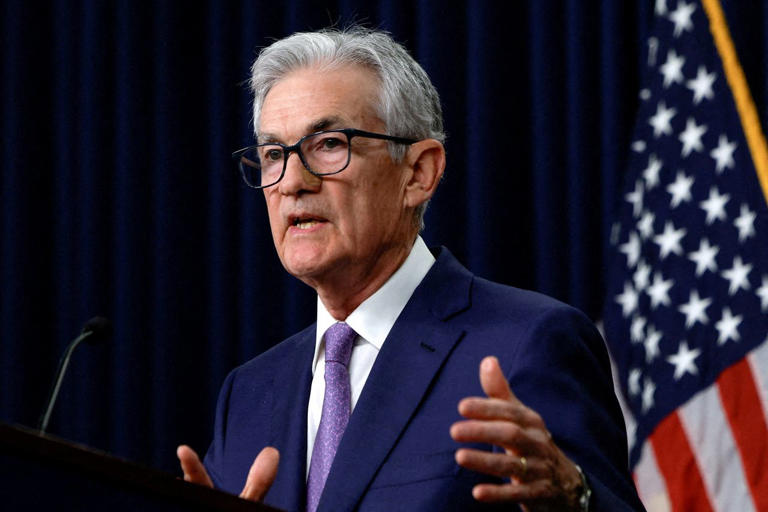

In the U.S., the Federal Reserve is widely expected to maintain the federal funds target range at 5.25%-5.50% during its upcoming meeting on Wednesday. Investors are increasingly confident that rate cuts will commence in September, with keen anticipation for any indications from the Fed. Analysts at TD suggest that while Chairman Jerome Powell may not fully commit to a September rate cut, he is likely to signal that the Fed is nearing that point. The upcoming U.S. elections add another layer of uncertainty to the number and timing of rate cuts.

Volker Schmidt, a portfolio manager at Ethenea, notes the possibility of an earlier rate cut, potentially as soon as next week, if evidence of slowing inflation emerges. However, current indicators suggest the decision-makers require more convincing signs of a sustained decrease in inflation.

Market expectations, according to Refinitiv data, place a low probability on a rate cut in July but are fully pricing in a reduction by September. Beyond the Fed’s decision, the health of the U.S. jobs market will be critical, with the latest nonfarm payrolls data for July due on Friday. Additional economic indicators, such as JOLTS job openings, ADP private payrolls, and weekly jobless claims, will also be scrutinized.

Furthermore, forward-looking indicators like the July Conference Board consumer confidence index and the ISM manufacturing index for July will provide a more up-to-date picture of the U.S. economy. The Treasury’s upcoming auctions of 13-week and 26-week bills, along with the announcement of quarterly refunding plans, will also be of interest to investors.

Europe

In Europe, the spotlight is on the U.K., where the Bank of England’s upcoming decision is anticipated to be a close call. The debate centers on whether to reduce interest rates by 25 basis points or to maintain the current rate of 5.25%. Despite annual headline inflation falling to 2.0%, concerns about wage and service-price inflation persist. Barclays economists predict a narrow 5-4 vote in favor of a rate cut, framing it as a reduction in restrictiveness rather than a shift to an accommodative stance. Should the BOE opt to hold rates steady, it is expected to signal potential rate cuts in September, limiting any significant impact on sterling or gilt yields.

Key U.K. economic data includes mortgage and consumer credit figures, the CBI’s distributive trades survey on retail sales, and the final July manufacturing purchasing managers’ index. Additionally, new finance minister Rachel Reeve’s review of public finances and the U.K. Debt Management Office’s sale of July 2034 gilts will be closely monitored.

In the Eurozone, provisional inflation figures for July and the first estimate of Q2 GDP will be pivotal. Recent purchasing managers’ surveys indicate a stalling economic recovery. Analysts at LBBW forecast a decline in inflation from 2.5% to 2.3%, potentially supporting further rate cuts by the European Central Bank (ECB) in September. Economic growth data and business and consumer surveys will provide further insights into the region’s economic health.

Asia

In Asia, the Bank of Japan’s policy meeting is highly anticipated. Analysts are divided on whether the central bank will raise its policy rate. The yen’s recent strength complicates the decision, as a stronger currency could slow inflation by reducing import costs. However, Japanese politicians have called for tighter policy to mitigate yen weakness, with inflation running above the BOJ’s 2% target for over two years.

The BOJ is expected to announce plans for reducing its Japanese government bond purchases and release its quarterly outlook on prices and growth. Key economic data, including labor market figures, retail sales, and industrial production numbers, will be assessed for signs of economic activity.

Other Regions

Canada: Canadian monthly gross domestic product data for May are due on Wednesday. These come in the wake of back-to-back interest-rate cuts by the Bank of Canada and expectations of more to come amid concerns about the economic outlook.

Australia & New Zealand: Australia faces a potentially significant week with the release of Q2 inflation data on Wednesday, which could prompt further interest rate increases by the Reserve Bank of Australia. Retail sales and building approvals data will also be pivotal. Inflation data has proven sticky all year, and the RBA has had to reinstate a hawkish bias over recent months, with Governor Michele Bullock telling markets that she won’t hesitate to resume raising the official cash rate if inflation appears to be gathering steam again.

China: In China, official PMI data for July will be crucial as policymakers address economic challenges. Despite recent rate cuts and policy measures, analysts remain cautious about the economy’s strength. Taiwan and Hong Kong will also release Q2 economic estimates, with expectations of a slowdown.

South Korea: South Korea will report on industrial production, trade data, and inflation, with export momentum being a key focus. “We expect exports to remain firm in H2 2024, underpinned by a further recovery in the tech cycle,” Barclays economist Bum Ki Son said, with demand for new-generation chips set to drive further growth in production.

Singapore: A key gauge of Singapore’s manufacturing activity for July is due out on Friday and will be watched for signs of continued recovery. Singapore also reports second-quarter employment data on Wednesday, which analysts expect to show continued tightness.

Conclusion

The upcoming decisions by central banks in the U.S., U.K., and Japan, along with significant economic data releases across various regions, will be pivotal in shaping global economic outlooks. Investors and policymakers alike will be paying close attention to these developments, seeking insights into future monetary policies and economic trajectories. The interplay of these decisions and data points will offer a comprehensive view of the global economic landscape, guiding market participants through a period of heightened uncertainty and potential opportunity.