Constellation Research recently made a bold prediction regarding Nvidia’s stock, forecasting a significant surge of 65% to reach $200 per share within the next year. This projection underscores their confidence in Nvidia’s strategic position and growth prospects in the rapidly evolving technology sector, particularly in artificial intelligence (AI).

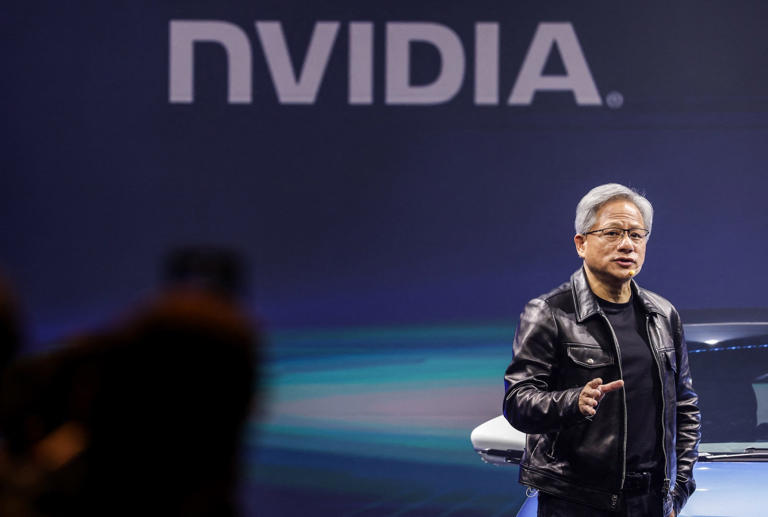

Ray Wang, the founder of Constellation Research, highlighted several key factors driving their optimistic outlook on Nvidia. First and foremost is Nvidia’s pivotal role as a foundational stock in the “Age of AI.” Wang emphasized that Nvidia’s CEO, Jensen Huang, plays a crucial role akin to visionary leaders in tech history such as Larry Ellison of Oracle and Mark Zuckerberg of Facebook. Huang’s leadership is seen as instrumental in steering Nvidia’s innovation and strategic direction, particularly in leveraging GPUs (Graphics Processing Units) for AI applications.

One of the critical moats identified by Constellation Research is the high barrier to entry in the semiconductor market, especially for advanced GPUs. Developing competitive products in this space requires substantial investment, expertise, and time, giving established players like Nvidia a significant advantage. Moreover, Nvidia benefits from high switching costs for its customers, particularly those integrated into its CUDA software ecosystem. Once businesses and developers adopt Nvidia’s GPUs and associated software, switching to competitors becomes economically and operationally challenging, ensuring strong customer retention.

Nvidia’s dominant market share in the GPU sector is another key factor supporting Constellation Research’s bullish outlook. The company’s technological leadership and continuous innovation have allowed it to maintain a significant lead over competitors, which translates into sustained market dominance and revenue growth.

Looking ahead, Constellation Research sees Nvidia’s strong product roadmap as a catalyst for future growth. Beyond its current product offerings, Nvidia is poised to introduce a new wave of innovations spanning hardware and software. This forward-looking approach positions Nvidia to capitalize on emerging opportunities in AI, machine learning, autonomous vehicles, and other high-growth sectors.

The GPU’s status as the default standard for AI applications further strengthens Nvidia’s market position. As AI continues to proliferate across industries, Nvidia remains at the forefront, providing essential hardware solutions for AI inference and testing. This entrenched position not only solidifies Nvidia’s revenue streams but also enhances its appeal among investors seeking exposure to the burgeoning AI market.

Financially, Nvidia has demonstrated robust performance metrics, including a high gross margin of 78% and a remarkable 262% year-over-year growth. These impressive figures underscore Nvidia’s operational efficiency and profitability, aligning with investor expectations for sustained financial strength and shareholder value creation.

Despite recent fluctuations in Nvidia’s stock price, including a 14% decline from its recent peak, Wang views these dips as buying opportunities. He attributes the pullback to broader macroeconomic concerns and profit-taking activities rather than fundamental weaknesses in Nvidia’s business model or growth prospects.

In conclusion, Constellation Research’s optimistic forecast for Nvidia reflects a comprehensive analysis of the company’s competitive advantages, leadership strength, technological prowess, and financial performance. Their projection of Nvidia’s stock reaching $200 per share within the next 12 months underscores their confidence in Nvidia’s ability to capitalize on the transformative potential of AI and maintain its leadership position in the semiconductor industry.