The ongoing bull market in U.S. stocks has significantly bolstered retirement accounts for millions of older Americans, particularly benefiting those at the top of the income ladder. These individuals have accumulated savings that far exceed their anticipated spending needs, highlighting the growing disparity in retirement readiness between high and low-income earners.

Analysis of Retirement Readiness

Vanguard researchers conducted a comprehensive analysis focusing on the retirement readiness of baby boomers. Their findings indicate that the top 5% of income earners have a savings surplus of nearly 30%. This means these high earners have saved 30% more than what they are expected to need for their retirement expenses. Overall, the retirement outlook has improved for all but the bottom quartile of wage earners, who still face a significant savings gap.

Encouraging Trends for Many

Kelly Hahn, head of retirement research at Vanguard Investment Strategy Group, commented on the positive trends in retirement readiness. “We see a meaningful improvement in retirement readiness for many baby boomers,” she said in a blog post. Despite this encouraging development, the data underscores a stark contrast in financial security among different income groups.

Disparities in Savings

Stock market gains have primarily benefited those with the most wealth and highest equity allocations. Consequently, the gap between high-income and low-income earners in terms of retirement readiness has widened. Workers in the bottom quartile face a daunting 36% savings gap between their sustainable replacement rate (the portion of pre-retirement income they can sustainably withdraw each year) and their expected spending needs in retirement. In contrast, median income earners have seen their retirement savings gap narrow by eight percentage points to 25%.

Data and Market Performance

Vanguard’s analysis relies on data from the Federal Reserve’s 2019 and 2022 Survey of Consumer Expectations, coupled with the performance of the S&P 500 from the end of 2019 through 2022. Given the market’s continued strength, retirement assets are likely even higher today. This is corroborated by Federal Reserve data, which reveals that the value of equity and mutual fund holdings among those aged 55 and older has surged by $5.5 trillion in the past year and nearly $17 trillion since the pandemic began in early 2020.

Contrasting Confidence Levels

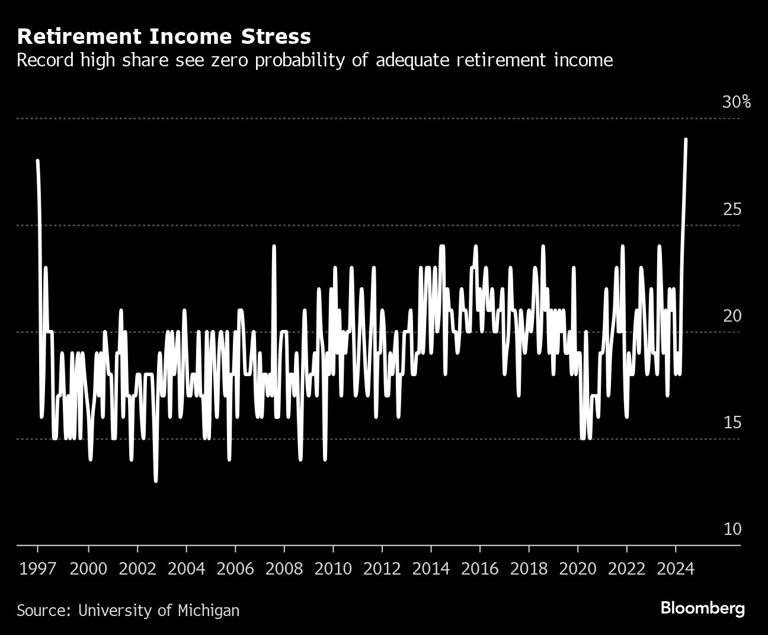

Despite the growth in retirement accounts for those at the top, there is a contrasting trend in retirement confidence. A record high share of people now report zero confidence in having a comfortable retirement. This lack of confidence is likely tied to the increasing cost of living, which has eroded the financial stability of those without substantial savings.

The Bigger Picture

The disparity in retirement readiness reflects broader economic inequalities. While those with significant assets have benefited immensely from market gains, many retirees and near-retirees remain vulnerable. This situation underscores the need for targeted financial planning and policy measures to address these gaps. Ensuring that all retirees have access to adequate savings opportunities and financial security is essential for a more equitable retirement landscape.

Financial Planning and Policy Measures

To address these disparities, financial planners and policymakers need to focus on several key areas:

- Enhanced Savings Opportunities: Creating programs that encourage and facilitate savings for low and middle-income earners can help bridge the retirement savings gap. This includes offering matching contributions, tax incentives, and automatic enrollment in retirement plans.

- Financial Education: Providing comprehensive financial education can help individuals make informed decisions about saving, investing, and managing their retirement funds. This education should be accessible and tailored to different income groups to address specific needs and challenges.

- Affordable Healthcare: Since healthcare costs are a significant concern for retirees, policies that ensure affordable healthcare can alleviate some financial burdens. Expanding Medicare coverage and controlling prescription drug prices are potential strategies to consider.

- Social Security Adjustments: Adjusting Social Security benefits to better reflect the actual cost of living increases can provide more financial stability for retirees. This could involve revising the cost-of-living adjustment (COLA) formula to ensure it keeps pace with inflation.

- Flexible Work Options: Encouraging flexible work options for older adults who wish to continue working can help them supplement their retirement income. This includes part-time work, remote work opportunities, and phased retirement programs.

The bull market has undeniably improved the retirement prospects for many Americans, particularly those at the top of the income distribution. However, the persistent gap between high and low-income earners poses a significant challenge. By implementing effective strategies and policies that enhance savings opportunities, provide financial education, ensure affordable healthcare, adjust Social Security benefits, and offer flexible work options, we can work towards a more equitable retirement landscape. Ensuring that all retirees have the financial security they need is essential for the well-being of the aging population and the overall health of the economy.