The U.S. economy kicked off the year 2024 on a promising note, building upon the momentum from a robust performance in the preceding year. Despite facing headwinds such as elevated interest rates, consumers in the United States remained resilient, demonstrating continued enthusiasm for spending.

Analysts anticipate that the upcoming report from the Commerce Department will reveal that the gross domestic product (GDP) expanded at a moderate pace of 2.2% on an annual basis during the first quarter of the year. However, some economists are more optimistic, suggesting that the growth rate could be even stronger, with projections indicating a potential annual pace of 2.7%. This optimism is fueled by a substantial 3.3% increase in consumer spending, which serves as the primary driver of economic growth.

Nevertheless, it’s expected that the pace of economic expansion has slowed compared to the vigorous 3.4% annual growth rate recorded in the final quarter of the previous year. This deceleration can largely be attributed to the Federal Reserve’s aggressive monetary policy actions, including a series of 11 interest rate hikes aimed at curbing inflationary pressures. These hikes have resulted in significantly higher borrowing costs for home mortgages, auto loans, credit cards, and various business loans, thereby tempering economic activity.

Despite this slowdown, the United States maintains its position as a global economic leader, outpacing other advanced economies around the world. Projections from the International Monetary Fund (IMF) suggest that the U.S. economy is poised to grow by 2.7% in 2024, surpassing growth forecasts for major European economies and Japan. This growth rate is more than double the expected global growth rate and reflects the underlying strength of the U.S. economy.

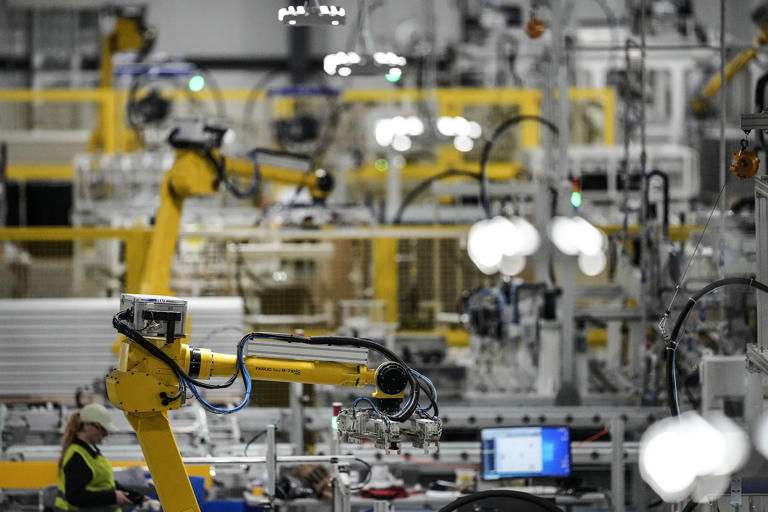

Consumer spending remains a cornerstone of the U.S. economy, accounting for approximately 70% of the nation’s GDP. The robustness of consumer activity was evident in the notable surge of retail sales, which exceeded economists’ expectations by almost double. Additionally, businesses have been buoyed by federal incentives aimed at promoting domestic manufacturing, leading to increased investments in infrastructure such as factories, warehouses, and other facilities.

However, challenges persist, particularly in the realm of international trade. The ongoing imbalance between imports and exports has acted as a drag on economic growth, contributing to a more tempered expansion in the first quarter. Furthermore, while inflation has moderated from its peak in mid-2022, it remains a concern. Despite the Fed’s proactive stance in raising interest rates to combat inflation, price pressures have only modestly abated.

In the political arena, inflation has become a contentious issue, with critics of President Joe Biden’s administration attributing blame for high prices to his policies. Despite positive economic indicators such as a robust labor market and a flourishing stock market, public sentiment regarding inflation has fueled political discourse.

Looking ahead, the Federal Reserve’s monetary policy remains under scrutiny. While expectations of multiple rate cuts this year have been prevalent, recent signals suggest a more cautious approach, with a potential delay in rate cuts until later in the year. This reflects the Fed’s desire for a balanced policy response amid ongoing inflationary pressures and global economic uncertainties.

Overall, the U.S. economy continues to demonstrate resilience, supported by robust consumer spending, favorable labor market conditions, and accommodative fiscal policies. Despite the challenges posed by inflation and global economic dynamics, the underlying strength of the U.S. economy provides a foundation for continued growth and prosperity.