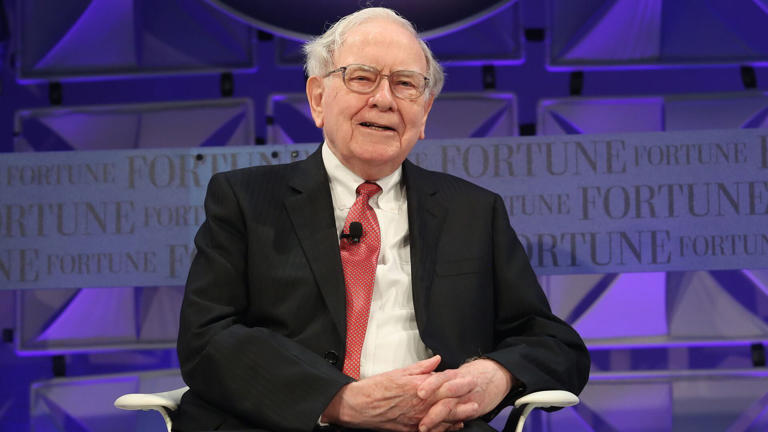

The 5/25 rule, often associated with Warren Buffett’s strategic approach to goal setting, serves as a testament to his philosophy on simplicity and focus. By employing this rule, individuals can not only refine their professional objectives but also streamline their financial planning and investment strategies for better wealth management.

The essence of the 5/25 rule lies in prioritization and focus. It involves making a list of the top 25 goals or aspirations one wants to achieve, whether they’re related to career, personal development, relationships, or financial objectives. From this list, individuals are then instructed to identify the five most crucial goals—the ones that hold the highest significance and align most closely with their values, long-term vision, and aspirations.

Once these top five goals are identified, the rule dictates complete focus and dedication to achieving them. This means allocating the majority of time, energy, and resources towards these priorities, while deprioritizing or even eliminating the remaining goals to avoid dilution of effort and attention.

By adhering to the 5/25 rule, individuals can cultivate clarity, direction, and efficiency in their pursuits. They can avoid the common pitfalls of spreading themselves too thin or succumbing to distractions, thereby maximizing their potential for success and fulfillment.

The Origin of the 5/25 Rule

The 5/25 rule originated from a candid conversation between Warren Buffett and Mike Flint, a pilot renowned for flying four U.S. presidents. When Flint sought guidance from Buffett on advancing his career, the billionaire investor suggested a straightforward yet impactful exercise: listing down 25 professional priorities and then identifying the top five among them. These top five priorities formed Flint’s A-list, representing the goals that warranted his utmost focus and commitment. Meanwhile, the remaining 20 items were designated as a B-list—a set of goals to be avoided at all costs, according to Buffett’s advice.

Applying the 5/25 Rule to Financial Goals

The elegance of the 5/25 rule lies in its simplicity and broad applicability, extending well beyond career goals to personal finance and wealth accumulation strategies. Here’s how you can apply this rule to transform your savings into significant wealth:

- Identify your financial goals: Begin by compiling a list of 25 financial goals or objectives you wish to achieve. These could include paying off debt, saving for a down payment on a house, investing in the stock market, or planning for retirement.

- Narrow down to your top five: Review your list carefully and select the top five goals that are most critical to your financial well-being and long-term success. These should be the objectives that will have the most substantial impact on your financial future.

- Focus relentlessly: As per Buffett’s advice, direct your undivided attention and resources towards these five prioritized goals. Invest your time, energy, and savings into achieving these priorities while intentionally avoiding distractions from the other 20 goals.

- The B-list—avoid at all costs: Consider everything not included in your top five goals as potential distractions from your primary objectives. Buffett’s insight suggests that spreading yourself too thin across numerous goals can hinder progress on the most crucial ones. Therefore, until your top five goals are accomplished, avoid allocating significant resources or effort to the other 20 goals.

- Reassess and adapt: Upon achieving a goal from your A-list, take the opportunity to reassess your priorities. You may consider moving an item from your B-list to the A-list if circumstances change or new opportunities arise. Continuously focus your efforts on your most impactful financial objectives, adapting as needed along the way.

By applying the 5/25 rule to your financial planning and wealth accumulation strategies, you can streamline your efforts, maximize your resources, and ultimately achieve significant progress towards your financial goals.

Why It Works

The strength of the 5/25 rule lies in its ability to compel prioritization. In a world filled with opportunities and distractions, pursuing too many objectives can lead to dilution of effort and minimal progress overall. By concentrating your focus on a select few critical goals, you can allocate your time, energy, and resources more efficiently, substantially increasing your likelihood of success.

Transforming Savings Into Wealth

For those seeking to grow their savings into substantial wealth, the 5/25 rule serves as a valuable guide. It underscores the importance of prioritizing investments in areas of highest significance while steering clear of short-term distractions or speculative ventures. This disciplined approach to financial planning fosters more intentional savings habits, wiser investment decisions, and ultimately, significant wealth accumulation.

Following the 5/25 rule demands patience and a long-term perspective. Attaining the most significant financial goals often requires sustained effort over time, but the rewards are considerable. Whether it involves achieving financial independence, securing a comfortable retirement, or leaving a lasting legacy, the clarity and focus instilled by the 5/25 rule can be truly transformative.

Final Take

Warren Buffett’s 5/25 rule offers a simple yet powerful framework for not just setting goals but achieving them with unwavering focus. By applying this rule to your financial planning and savings strategy, you can prioritize your efforts on the goals that matter most, effectively turning your savings into wealth. Remember, the key to financial success is not how many goals you can work on simultaneously, but how well you can concentrate your resources on achieving the few that are truly significant.