Uber, a prominent player in the ride-hailing industry, faced a substantial setback when it reported an unexpected quarterly loss, leading to a significant decline in its stock price. This unexpected turn of events disrupted the prevailing optimism among investors on Wall Street regarding Uber’s journey towards profitability.

The sharp decline in Uber’s stock price on Wednesday marked its most significant daily percentage loss since October 2022. Shares plunged by 8% to $65 per share shortly after the market opened, resulting in a staggering loss of $12 billion in market value for Uber. This downturn pushed the stock to its lowest intraday level since late January, leaving investors grappling with unexpected losses.

The primary catalyst for Uber’s disappointing financial performance in the first quarter was its reported loss of $0.32 per share. This figure starkly contrasted with consensus estimates of a $0.22 profit per share, marking an unexpected departure from the company’s streak of consecutive profitable quarters. The reported net loss of $654 million represented Uber’s most significant quarterly loss since the third quarter of 2022, amplifying concerns among investors.

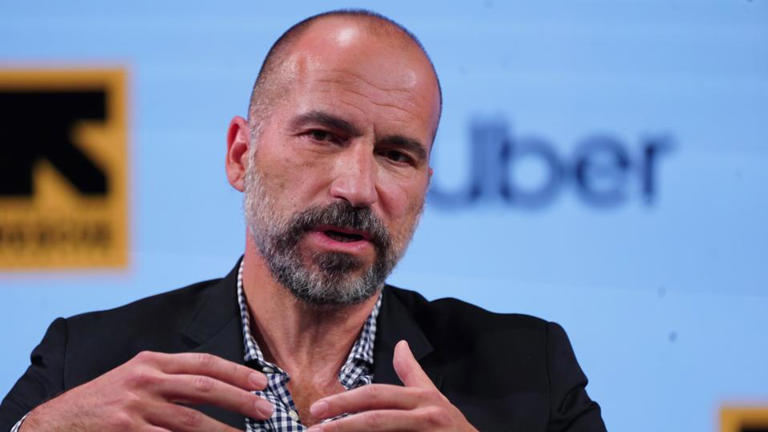

Despite these setbacks, Uber CEO Dara Khosrowshahi was quick to emphasize that the disappointing bottom-line results were unrelated to the company’s core operating business. Instead, the loss was attributed to a writedown of equity investments, as indicated in the earnings release. Notably, Uber’s adjusted EBITDA reached a record $1.38 billion, surpassing analyst estimates and demonstrating an 82% increase compared to the same period last year.

While Uber’s total revenue of $10.1 billion slightly exceeded forecasts, its gross bookings fell short of expectations at $37.7 billion. These mixed financial figures fueled investor apprehension and contributed to the substantial sell-off of Uber’s stock.

Despite the market’s initial reaction, some analysts believe that the sell-off was excessive. JPMorgan analysts Doug Anmuth and Neeraj Kookada highlighted their $95 price target for Uber, suggesting nearly 50% upside potential. This indicates their confidence in Uber’s long-term prospects, despite the current challenges.

However, the market’s reaction underscores investors’ impatience regarding Uber’s path to profitability, particularly as the company approaches its five-year anniversary as a public company. Despite analysts’ optimistic projections for Uber’s bottom line growth, uncertainty lingers regarding the company’s ability to meet market expectations amidst evolving market dynamics.

In summary, Uber’s unexpected quarterly loss triggered a significant downturn in its stock price, highlighting investors’ concerns over the company’s profitability trajectory and its ability to navigate challenges effectively in the competitive ride-hailing industry.