Struggling European governments are gazing across the Atlantic with envy as the United States appears to boast a booming economy, a sharp contrast to their own economic challenges and sluggish growth.

The economic divergence between the United States and Europe became particularly apparent amid contrasting economic performances. While Britain found itself slipping into a technical recession in the latter half of the previous year, the U.S. was proudly touting a robust 3.4% annualized growth in its final quarter. However, despite this seemingly strong economic performance, Americans continue to express discontent about the state of the economy, consistently ranking it as a top concern in various polls and surveys.

Recent revelations have shed light on the validity of American apprehensions. It was disclosed this week that the pace of growth in the United States has notably decelerated, with an annualized growth rate of 1.6% recorded in the first three months of the year. This figure fell well below the consensus forecast of 2.4%, signaling a significant slowdown compared to previous quarters.

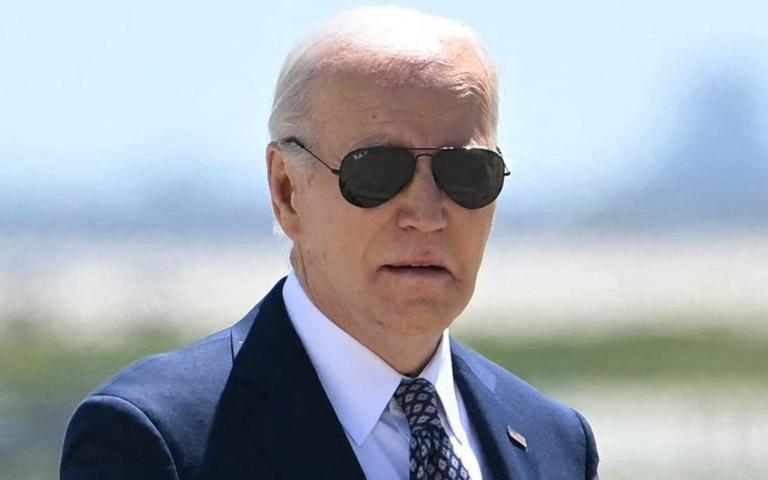

This slowdown in growth underscores mounting evidence suggesting that much of the recent economic expansion in the U.S. may have been fueled by temporary factors rather than sustainable, long-term growth drivers. Critics argue that the spending spree initiated by the Biden administration, including substantial fiscal stimulus measures, may have artificially propped up certain sectors of the economy, leading to a skewed perception of economic health.

Public skepticism surrounding the Bidenomics approach has been evident for some time. In January, a Gallup poll revealed that 45% of respondents viewed the economy as “poor,” while 63% believed it was “getting worse.” These sentiments appear to have been validated by recent economic data, which paints a less rosy picture than previously perceived.

Although the U.S. economy continues to outpace its counterparts, with the International Monetary Fund projecting it to lead major advanced economies in growth this year, concerns persist. Inflation in the U.S. surged to 3.4% in the first quarter of 2024, exceeding the Federal Reserve’s 2% target. This uptick in inflation has complicated the Fed’s monetary policy decisions, prompting speculation about the timing and magnitude of potential interest rate adjustments.

The prospect of delayed rate cuts by the Federal Reserve has implications beyond the U.S. economy, affecting global financial markets and geopolitical dynamics. In the United Kingdom, for instance, economic policymakers may face similar pressures as they navigate the delicate balance between addressing inflationary pressures and supporting economic recovery.

The evolving economic landscape has significant political ramifications, particularly in the run-up to elections. In both the U.S. and the UK, incumbent governments may find themselves grappling with economic challenges that could shape electoral outcomes. The possibility of slower economic growth and delayed rate cuts may influence voter sentiment and political strategies.

Against this backdrop, discussions about central bank independence have resurfaced, with some advocating for greater political influence over monetary policy decisions. However, maintaining central bank independence is crucial for ensuring sound economic governance and preserving financial stability.

Ultimately, the interplay between economic data, monetary policy decisions, and political dynamics will continue to shape the trajectory of both the U.S. and European economies, with far-reaching implications for global markets and geopolitical relations.