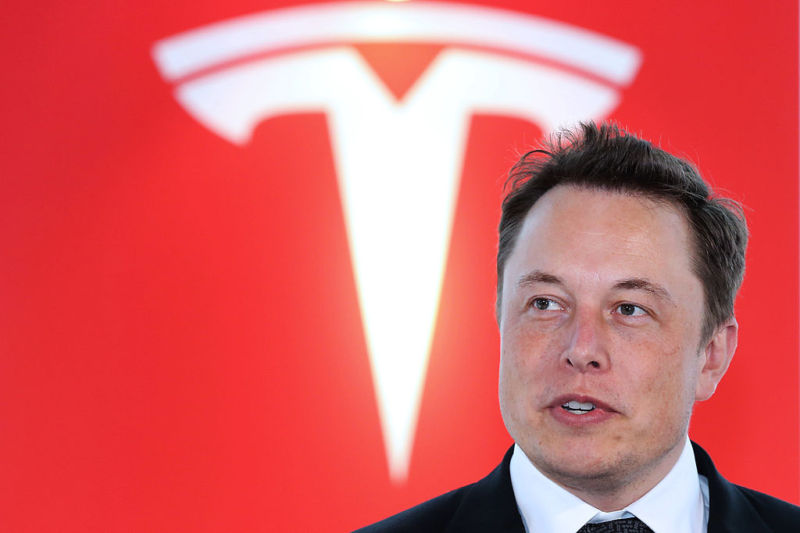

Tesla (NASDAQ:TSLA) CEO Elon Musk’s $46 billion compensation package is encountering significant resistance once again, adding another layer of complexity to the ongoing saga surrounding executive pay in the corporate world. The latest challenge to Musk’s compensation plan comes from proxy advisory firm Glass Lewis & Co., which has recommended that Tesla shareholders vote against the proposed pay package. This advisory follows a similar call from a group of Tesla shareholders, including notable entities like Amalgamated Bank (AMAL) and the SOC Investment Group, who have also urged investors to reject Musk’s compensation package, citing various concerns.

Among the primary concerns raised by Glass Lewis is the sheer magnitude of Musk’s proposed pay plan and its potential impact on stock dilution, which could adversely affect the value of existing shareholders’ holdings. Additionally, the firm highlighted the fact that the proposed package would significantly bolster Musk’s ownership stake in Tesla, potentially consolidating his position as the largest shareholder by a considerable margin. This concentration of ownership could raise concerns about governance and decision-making within the company, particularly given Musk’s involvement in multiple high-profile ventures beyond Tesla, such as SpaceX and Neuralink.

The journey of Elon Musk’s compensation package has been marked by controversy and legal challenges. Originally approved by Tesla shareholders in 2018, the package included a 10-year grant of stock options, divided into 12 vesting tranches contingent on Tesla achieving a market capitalization of at least $650 billion, along with various revenue and profit milestones. However, this plan was voided by a Delaware court in January due to concerns about the approval process, prompting renewed scrutiny of Musk’s compensation arrangements.

Glass Lewis’s current stance on Musk’s compensation echoes its previous reservations expressed in 2018, underscoring ongoing concerns about the alignment of executive pay with shareholders’ interests and the independence of Tesla’s board in making such decisions. Shareholders’ skepticism towards Musk’s compensation plan revolves around its substantial size and the potential for it to undermine the independence and accountability of Tesla’s board.

In terms of investment implications, Tesla currently holds a consensus rating of “Hold” among analysts, with a mixed outlook based on nine Buy ratings, 14 Hold ratings, and nine Sell ratings. The average price target for Tesla stock is $174.60, suggesting a modest downside potential from its current levels. Year-to-date, Tesla’s stock has experienced significant volatility, declining by approximately 28% amid broader market uncertainty and concerns about Musk’s compensation package.

For investors considering a stake in Tesla, it may be prudent to heed the advice of respected analysts like Robert W. Baird’s Ben Kallo, who has established a strong track record in covering Tesla stock. Kallo’s insights and recommendations could provide valuable guidance amidst the ongoing debate surrounding Musk’s compensation and its implications for Tesla’s long-term prospects.

In summary, while Tesla remains a leading player in the electric vehicle market and a favorite among tech enthusiasts, the controversy surrounding Musk’s compensation underscores broader concerns about corporate governance and shareholder value. As investors navigate these complexities, thorough due diligence and careful consideration of the risks and rewards associated with holding Tesla stock are paramount.