Thursday’s significant selloff in the stocks of major technology companies, collectively known as the “Magnificent Seven,” marked one of the largest single-day declines in market capitalization on record for these industry leaders. The group, comprising Nvidia Corp., Meta Platforms Inc., Alphabet Inc., Amazon.com Inc., Apple Inc., Microsoft Corp., and Tesla Inc., collectively shed $598 billion in market value in just one trading session. This sharp decline represents the most substantial loss since February 3, 2022, when these stocks collectively lost $602 billion in market cap, as reported by Dow Jones Market Data.

Among the Magnificent Seven, Tesla Inc. saw the most significant drop, plummeting 8.4% and ending its notable 11-session winning streak abruptly. This decline marked Tesla’s largest single-day percentage decline since January 25, driven in part by news from Bloomberg indicating a delay in its highly anticipated robotaxi event from August to October. This delay prompted a swift market reaction, underscoring investor sensitivity to Tesla’s strategic timelines and their impact on market sentiment.

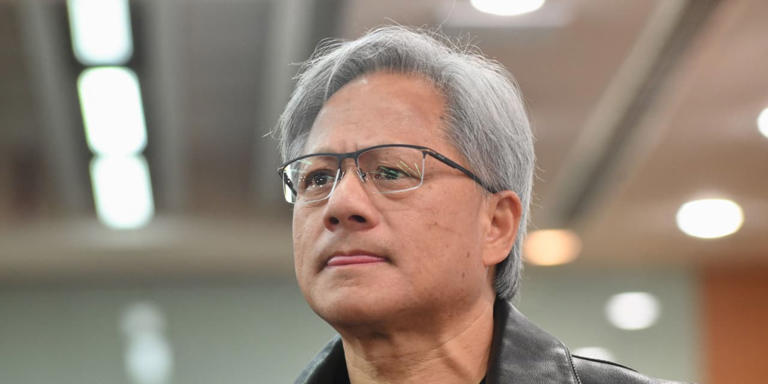

Following Tesla’s lead, Nvidia Corp. and Meta Platforms Inc., which have been standout performers so far this year, also experienced notable declines of over 4% each. The broader weakness across the technology sector on Thursday was largely attributed to investor reactions to the latest U.S. consumer price index (CPI) data, which indicated a moderation in inflationary pressures. This data bolstered expectations in the market that the Federal Reserve might consider a rate cut as early as September, prompting investors to reassess their positions in high-growth technology stocks.

Interestingly, the market’s response reflected a pivot towards sectors expected to benefit from lower interest rates, such as homebuilders and other industries sensitive to borrowing costs. This shift in sentiment was evident as investors moved away from high-valuation tech stocks, which are perceived as less responsive to interest rate cuts due to their already lofty price-to-earnings ratios and growth expectations.

Mike O’Rourke, Chief Market Strategist at JonesTrading, highlighted the technology sector’s historical insensitivity to changes in interest rates, suggesting that these stocks may not derive substantial benefits from further monetary easing by the Fed. This perspective contributed to the broader narrative shaping Thursday’s trading session, influencing trading patterns across major indices.

Overall, Thursday’s selloff in the Magnificent Seven underscores the ongoing volatility and market sensitivity of technology stocks to macroeconomic indicators and central bank policies. It reflects the intricate interplay between economic data releases, investor sentiment shifts, and sector-specific dynamics in driving market movements, highlighting the challenges and opportunities inherent in investing in high-growth, high-valuation sectors like technology.