Key Takeaways:

- Super Micro Computer shares reached a new all-time high on Wednesday, buoyed by investor confidence in the company’s growth potential amid the AI industry boom.

- Analysts from Argus Research provided a positive outlook, suggesting that the company is positioned for several years of strong revenue growth, margin expansion, and earnings per share (EPS) acceleration, likening its trajectory to that of tech giants Nvidia, Apple, and Amazon.

- Argus Research assigned a buy rating to Super Micro Computer stock and set a price target of $1,350, indicating further upside potential from its current levels.

- On Wednesday, the stock closed at $1,124.70, marking a 3.1% increase for the day. Since the beginning of 2024, the stock has quadrupled in value, reflecting robust investor enthusiasm for the company’s future prospects.

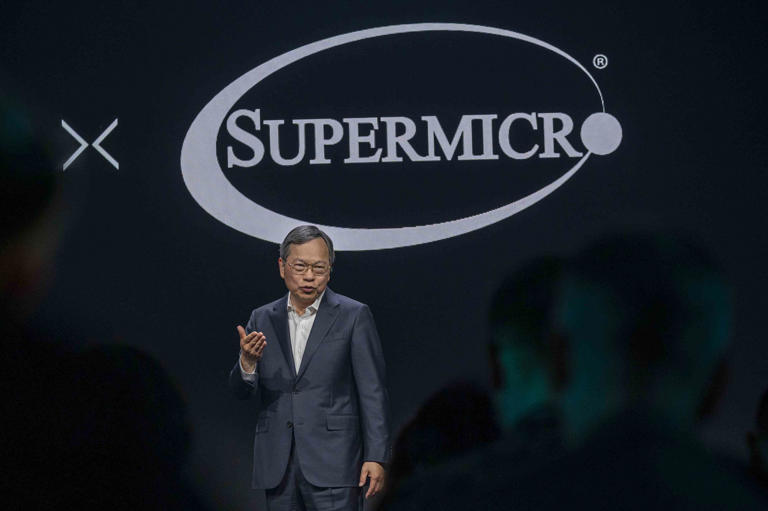

Super Micro Computer (SMCI) shares surged to a fresh all-time high on Wednesday, buoyed by increasing optimism surrounding the company’s growth prospects driven by the surging demand for products and services related to artificial intelligence.

Having already quadrupled in value since the beginning of the year, the stock climbed 3.1% during the trading session, closing at $1,124.70.

According to analysts at Argus Research, Super Micro is at the forefront of providing computer and server solutions tailored for the era of generative AI. Despite its substantial gains over the past year, the company is viewed as poised for sustained top-line growth, margin expansion, and acceleration in earnings per share (EPS) over the coming years.

Argus Research reiterated a “buy” rating for Super Micro’s stock and established a 12-month price target of $1,350.

The analysts highlighted Super Micro’s emergence as a key player in delivering data center infrastructure for GPU Computing, crucial for various AI applications such as training large language models, inference, and deep learning. They drew parallels between Super Micro’s growth trajectory and that of tech giants like Apple, Amazon, and Nvidia, emphasizing its potential for significant revenue expansion while managing costs effectively.

As Super Micro prepares to join the S&P 500 index later this month, its partnerships with semiconductor leaders such as Nvidia and Advanced Micro Devices (AMD) further reinforce its strategic positioning within the AI ecosystem, potentially amplifying its growth opportunities in the sector.