Global shares exhibited a mixed performance on Wednesday, reflecting investor uncertainty amid new data signaling a slowdown in the U.S. economy. This deceleration presents both potential benefits and drawbacks for Wall Street, as market participants grapple with the implications.

European Markets Show Modest Gains

In Europe, major stock indices demonstrated modest upward momentum. France’s CAC 40 increased by 0.4% to 7,966.52, buoyed by positive sentiment across various sectors. Germany’s DAX also saw a rise of 0.6% to 18,516.05, reflecting strong performances from industrial and financial stocks. Britain’s FTSE 100 edged up by 0.2% to 8,249.33, supported by gains in consumer goods and healthcare shares.

U.S. Futures Point to Slight Optimism

U.S. futures indicated a cautious optimism among investors. The future for the Dow Jones Industrial Average rose by 0.2%, suggesting a positive opening for the blue-chip index. Similarly, the S&P 500 futures increased by 0.1%, indicating a potential continuation of the previous day’s modest gains. These movements reflect a market still weighing the impact of recent economic data and anticipating future monetary policy actions.

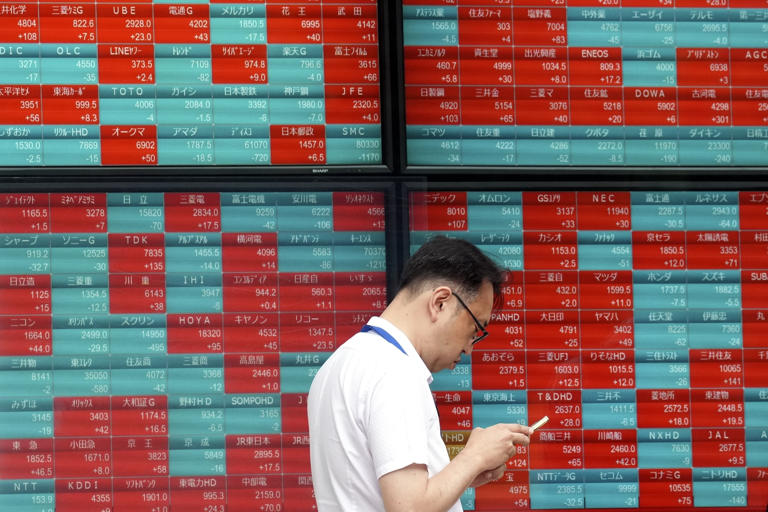

Asian Markets Reflect Divergence

Asian markets presented a mixed picture. Japan’s benchmark Nikkei 225 declined by 0.9% to close at 38,490.17, pressured by profit-taking and concerns over global economic growth. Australia’s S&P/ASX 200, however, edged up by 0.4% to 7,769.00, driven by gains in mining and financial stocks. South Korea’s Kospi jumped by 1.0% to 2,689.50, benefiting from strong performances in technology and automotive sectors.

Conversely, Hong Kong’s Hang Seng slipped by 0.1% to 18,424.96 amid geopolitical tensions and regulatory uncertainties affecting tech giants. The Shanghai Composite fell by 0.8% to 3,065.40, weighed down by weaker-than-expected economic data and ongoing property market concerns.

Australian Economic Data: A Mixed Bag

Australia’s economy grew by just 0.1% in the first quarter, according to data released on Wednesday. This tepid growth was below expectations and highlights the challenges facing the Reserve Bank of Australia (RBA). Tim Waterer, chief market analyst at KCM Trade, noted that the RBA is in a difficult position, balancing slowing economic activity with rising inflation. The central bank’s policy decisions in the coming months will be closely scrutinized by investors and economists alike.

Japanese Wage Growth and Monetary Policy

In Japan, cash income for workers rose by 2.1% in May, surpassing forecasts and indicating robust wage growth. Analysts believe that the impact of recent spring labor negotiations will become more pronounced in the coming months. This wage growth could prompt the Bank of Japan to reconsider its ultra-loose monetary policy and potentially raise interest rates, a significant shift for an economy long accustomed to near-zero rates.

U.S. Markets: Modest Gains Amid Mixed Data

On Tuesday, U.S. markets saw modest gains despite mixed internal performance within indices. The S&P 500 ticked up by 0.2%, though more stocks within the index fell than rose, indicating a market grappling with sector-specific challenges. The Dow Jones Industrial Average increased by 0.4%, driven by strong earnings reports and positive economic data. The Nasdaq composite added 0.2%, reflecting gains in technology stocks.

Investors are keenly aware that a potential interest rate cut by the U.S. Federal Reserve could ease financial pressures but also risk pushing the economy into a recession. Such a scenario would lead to job losses, weaken corporate profits, and drag down stock prices.

Economic Indicators and Their Implications

Recent economic indicators have added to the market’s uncertainty. A report on Tuesday showed that U.S. job openings at the end of April fell to their lowest level since 2021, signaling potential cooling in the labor market. This followed a Monday report indicating that U.S. manufacturing contracted in May for the 18th time in 19 months, highlighting ongoing challenges in the industrial sector. These signs of economic slowdown have particularly impacted crude oil prices, suggesting a possible decline in future fuel demand.

Energy and Currency Markets

In energy trading, benchmark U.S. crude rose by 24 cents to $73.49 a barrel, while Brent crude, the international standard, increased by 26 cents to $77.78 a barrel. These modest gains reflect a market cautiously optimistic about future demand amid mixed economic signals.

In currency markets, the U.S. dollar strengthened against the Japanese yen, rising to 156.22 yen from 154.84 yen, driven by expectations of diverging monetary policies between the U.S. and Japan. The euro, however, slightly decreased to $1.0878 from $1.0883, reflecting ongoing uncertainties in the Eurozone economy.

Looking Ahead

As global markets react to the latest economic data and policy signals, investors remain vigilant, weighing the potential implications for future growth and stability. The interplay between slowing economic indicators, central bank policies, and geopolitical developments will continue to shape market sentiment in the coming weeks. Investors will closely monitor upcoming data releases and central bank communications for further insights into the global economic trajectory.