Thursday’s trading session unfolded with notable fluctuations across global markets, spurred by the Federal Reserve’s decision to delay interest rate cuts. Let’s delve deeper into the key highlights of the day:

1. U.S. Market Dynamics: Despite the initial volatility, U.S. stock futures painted a positive picture, indicating an upward trajectory. Futures for the S&P 500 and the Dow Jones Industrial Average showed gains of 0.5% and 0.4%, respectively. This optimism stemmed from the Federal Reserve’s announcement to maintain interest rates at their current levels, a move largely in line with market expectations.

2. European Market Performance: European markets opened with a mixed bag of outcomes. London’s FTSE 100 index witnessed a 0.4% increase, signaling early bullish sentiment. However, Germany’s DAX and France’s CAC 40 experienced slight declines, reflecting a more cautious approach among investors.

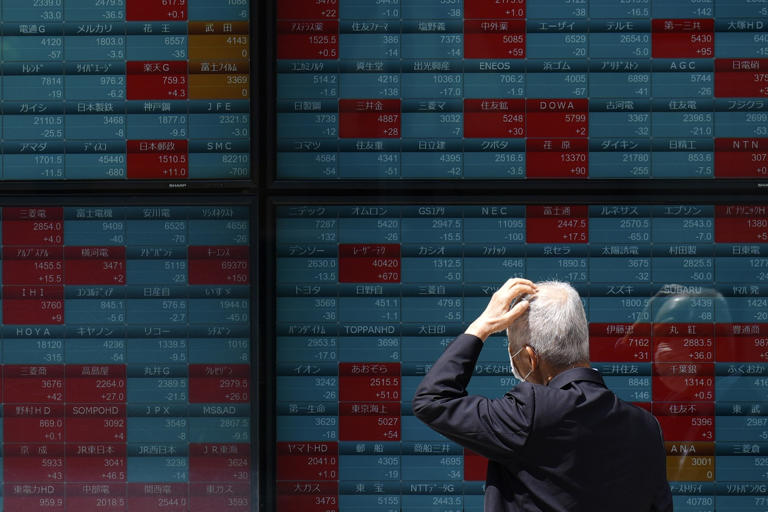

3. Asian Market Recap: In Asia, the Nikkei 225 index in Tokyo recorded a marginal slip, influenced by currency market dynamics. The Japanese yen saw initial volatility, surging by as much as 2% amid speculation of intervention by Japanese authorities. However, the yen later retraced its gains, contributing to market uncertainty.

4. Regional Variations: South Korea’s Kospi index faced a slight downturn following the release of consumer price data, highlighting the market’s sensitivity to economic indicators. Meanwhile, Hong Kong’s Hang Seng index surged by an impressive 2.4%, indicating robust investor confidence. However, markets in China remained closed for the Labor Day holiday, adding to the regional variation in trading activity.

5. Commodities and Currency Trends: In the commodities market, oil prices experienced a modest rebound after three consecutive days of losses. This uptick was supported by a weakening U.S. dollar, with both U.S. and Brent crude futures recording gains. In currency trading, the euro strengthened against the dollar, reflecting shifting dynamics in global currency markets.

6. Federal Reserve’s Influence: Federal Reserve Chair Jerome Powell’s remarks regarding inflation and interest rates significantly impacted market sentiment. While Powell acknowledged concerns about inflation, he adopted a cautious stance on rate cuts, disappointing some investors who had anticipated more aggressive monetary policy measures. Despite Powell’s assurances of the Fed’s commitment to supporting economic growth, uncertainty lingered in financial markets.

In summary, Thursday’s trading session underscored the intricate interplay between central bank policies, economic data, and investor sentiment. With market participants closely monitoring developments for further insights, the day’s fluctuations highlighted the ongoing quest for clarity amidst a backdrop of evolving global economic conditions.