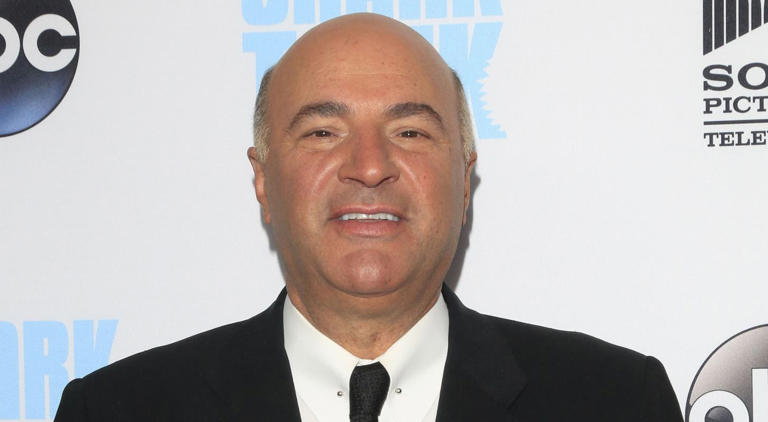

The recent debut of the first Bitcoin exchange-traded fund (ETF) represents a monumental step forward in the evolution of the cryptocurrency landscape. It signifies a pivotal moment where Bitcoin, the pioneering digital asset, becomes more accessible to a broader audience of investors. Yet, amidst this groundbreaking development, renowned investor and “Shark Tank” star Kevin O’Leary offers a distinctive perspective on the virtues of direct Bitcoin ownership compared to investing through an ETF.

In a recent interview with TheStreet, O’Leary acknowledged the significance of the Bitcoin ETF as a milestone in expanding access to Bitcoin investment for a wider range of individuals and institutions. However, he underscored his preference for direct ownership of Bitcoin over investing through an ETF due to the unnecessary fees associated with the latter. O’Leary questioned the added value of ETFs, arguing that investors could achieve similar exposure to Bitcoin by owning the cryptocurrency directly, thus avoiding additional expenses.

O’Leary’s stance reflects a belief in the importance of a hands-on approach to cryptocurrency investment, emphasizing the benefits of owning the underlying asset rather than investing through financial instruments like ETFs. While the introduction of the Bitcoin ETF represents a significant milestone in the mainstream acceptance of Bitcoin, O’Leary views it as a signal of the end of the “crypto cowboy” era—a period characterized by speculative fervor and regulatory ambiguity. He sees the emergence of regulated financial products like ETFs as a step towards integrating crypto technology into the traditional financial services sector.

Addressing the challenges within the crypto exchange market, O’Leary pointed to regulatory concerns surrounding platforms like Binance and FTX. He emphasized the importance of regulatory compliance and cited the emergence of compliant platforms like the M2 exchange in Abu Dhabi as a positive development in the industry. O’Leary’s remarks underscore the growing emphasis on regulatory compliance and investor protection within the cryptocurrency ecosystem.

In terms of his personal investment strategy, O’Leary views Bitcoin as “digital gold” and allocates a 5% weighting to it in his portfolio, alongside a similar allocation to physical gold. He adjusts his portfolio quarterly based on the performance of these assets, reflecting a disciplined and pragmatic approach to investment management. Additionally, O’Leary’s crypto portfolio includes other technologies like H-bar, Solana, and Polygon, comprising around 11% of his total investments.

Overall, O’Leary’s views highlight the ongoing maturation and evolution of the cryptocurrency market, with a growing emphasis on regulatory compliance, investor protection, and direct ownership of digital assets. While the introduction of the Bitcoin ETF represents a significant milestone, O’Leary remains steadfast in his belief in the value of owning Bitcoin directly and advocates for a cautious and informed approach to cryptocurrency investment.