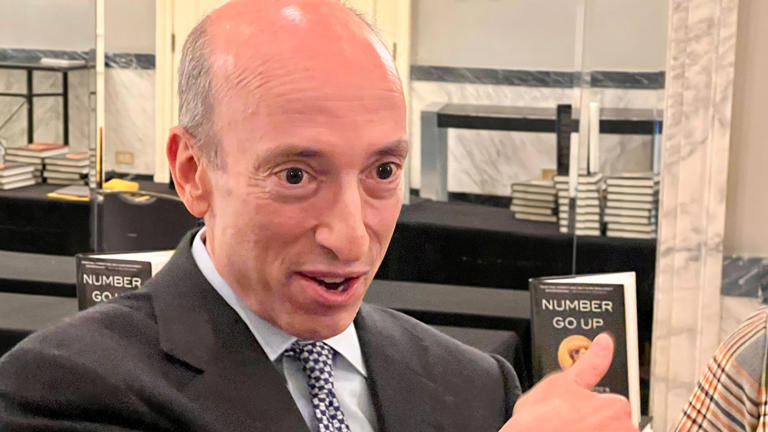

Gary Gensler, the chairman of the U.S. Securities and Exchange Commission (SEC), is advocating for the addition of 33 more staff members to the enforcement division in the agency’s annual budget proposal. This increase is aimed at addressing “new and emerging issues” within the financial markets.

The SEC’s enforcement efforts have increasingly focused on cryptocurrency businesses such as Coinbase Inc., Kraken, and Binance, reflecting the growing prominence of digital assets in the financial landscape. The agency’s pursuit of regulatory oversight in this space has necessitated additional resources to effectively monitor and enforce compliance.

The rise of cryptocurrencies has been acknowledged by several U.S. financial regulators, who have cited it as a key factor driving their budget requests. These requests are part of the agencies’ efforts to secure funding for their programs and initiatives, particularly in areas perceived as requiring enhanced oversight and regulation.

Both the Department of the Treasury and the Commodity Futures Trading Commission (CFTC) have underscored the importance of better monitoring the digital asset market and addressing related issues. As such, they have sought increased resources to bolster their capabilities in regulating cryptocurrencies and other emerging areas within the financial sector.

SEC Budget

In his executive summary of the budget request, Gary Gensler highlighted the challenges associated with regulating the digital assets sector, describing it as the “Wild West of the crypto markets.” He emphasized the prevalence of noncompliance and speculative behavior in this area, which poses risks to investors’ hard-earned assets.

To address these concerns, the SEC has intensified its efforts to regulate the crypto sector by expanding its enforcement capabilities. This includes increasing the number of enforcement lawyers dedicated to investigating digital assets-related violations. The proposed budget seeks additional funding to sustain and expand this trend, enabling the SEC to more effectively enforce compliance within the crypto markets.

Moreover, the SEC aims to bolster its examinations division by adding 23 new staff members to address evolving risks, including those associated with crypto activities. This investment is part of the agency’s broader $2.6 billion spending plan, aimed at enhancing its regulatory oversight and enforcement efforts across various sectors.

Recognizing the rapid emergence of new financial products and services, such as decentralized finance (DeFi) in the blockchain space, the SEC is also seeking to enhance its capabilities in data analysis and innovation. Specifically, the agency plans to recruit a data scientist to support its innovation hub, enabling it to better understand and respond to developments in the financial industry driven by technology and innovation.

CFTC requests

The CFTC’s budget request underscores its proactive approach to regulating the digital assets market, particularly through its enforcement division. Highlighting its enforcement actions against nearly 50 crypto companies in the past year and citing the successful settlement with Binance, the world’s largest crypto exchange, as an example, the agency emphasizes its commitment to ensuring compliance with statutory and regulatory requirements in the digital asset space.

Acknowledging the growing interest in crypto derivatives and the associated risks, the CFTC seeks additional resources to enhance its monitoring capabilities and address emerging challenges effectively. Moreover, the agency plans to expand its rulemaking efforts to include cryptocurrencies in data reporting for futures and options markets, reflecting its commitment to adapt regulatory frameworks to evolving market dynamics.

Furthermore, the CFTC’s request signals its ongoing efforts to secure greater oversight authority, particularly in the spot market, by providing technical advice to Congress on legislative matters related to digital assets. Additionally, the agency aims to raise public awareness about various fraud schemes, including those involving cryptocurrencies, through public service announcements, highlighting its commitment to investor protection and market integrity.

Treasury

The U.S. Securities and Exchange Commission (SEC) and other financial regulators are seeking increased funding to address emerging issues, particularly in the cryptocurrency space. SEC Chair Gary Gensler emphasized the challenges of regulating digital assets, citing concerns about noncompliance and investor risk. The SEC’s budget request includes additional staff for enforcement and examinations divisions to tackle crypto-related activities and evolving risks. Similarly, the Commodity Futures Trading Commission (CFTC) highlighted its enforcement actions against crypto firms and the need for enhanced monitoring due to the growing presence of crypto derivatives. The Treasury Department is also seeking increased funding to better engage with the cryptocurrency sector, with various divisions aiming to bolster their capabilities in understanding and regulating digital assets. Overall, regulators are emphasizing the importance of addressing regulatory gaps and ensuring compliance in the rapidly evolving crypto market landscape.