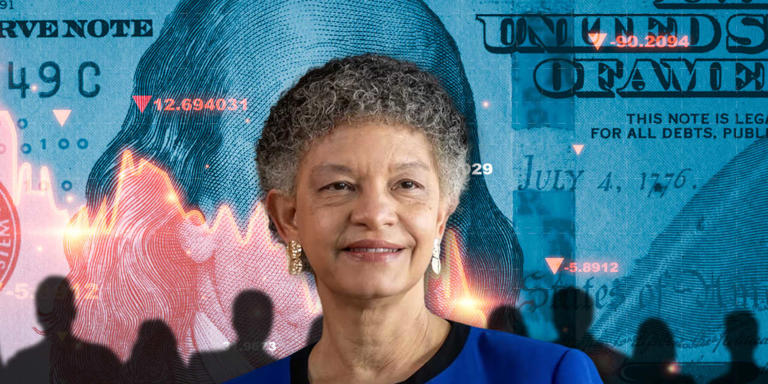

Boston Fed President Susan Collins delves into the intricacies of economic policy and public sentiment in a comprehensive discussion with MarketWatch. She underscores the nuanced relationship between consumer perceptions and the broader economic landscape, shedding light on key considerations shaping Federal Reserve strategies.

Despite positive economic indicators such as low unemployment rates and wage growth, Collins notes a persistent pessimism among consumers regarding the state of the economy. This sentiment, she explains, stems from various factors including elevated consumer prices and lingering uncertainties stemming from the COVID-19 pandemic.

In response to these challenges, the Federal Reserve has taken measures to address inflationary pressures by adjusting interest rates. However, Collins emphasizes the importance of recognizing the time it takes for these policy interventions to translate into tangible improvements in consumer sentiment and economic stability.

Moreover, Collins expresses concern about the potential for a self-perpetuating cycle of pessimism, wherein consumer and business behavior driven by apprehension could inadvertently dampen economic growth. This underscores the interconnectedness of public sentiment and economic performance, highlighting the need for policymakers to consider both qualitative and quantitative data in their decision-making process.

Addressing specific concerns within her district, Collins highlights the challenges related to housing affordability, which impact individuals across income levels. Additionally, she notes the dissipation of extra savings accumulated during the pandemic, coupled with persistently low savings rates, as areas of uncertainty warranting attention.

As a “realistic optimist,” Collins navigates the complexities of economic policymaking with a keen understanding of the multifaceted nature of economic challenges. She emphasizes the importance of qualitative research, such as the Fed’s Beige Book, in providing valuable insights into economic conditions beyond traditional metrics.

Regarding inflation and the job market, Collins underscores the Federal Reserve’s commitment to its target inflation rate of 2% as a cornerstone of its credibility. While inflation remains elevated, Collins finds optimism in the resilience of the labor market, suggesting that disinflation can occur alongside a robust employment landscape.

As the first Black woman to lead a regional Federal Reserve bank, Collins brings a unique perspective to economic policymaking, advocating for a holistic approach that considers both quantitative data and qualitative insights gleaned from public sentiment.