Key Takeaways:

- Ray Dalio, founder of Bridgewater, does not view the current stock market as being in a “full-on” bubble.

- However, he acknowledged that certain high-profile names appear to be “a bit frothy.”

- Dalio cautioned that there could be a significant correction in these names if generative AI fails to meet the expectations priced into the market.

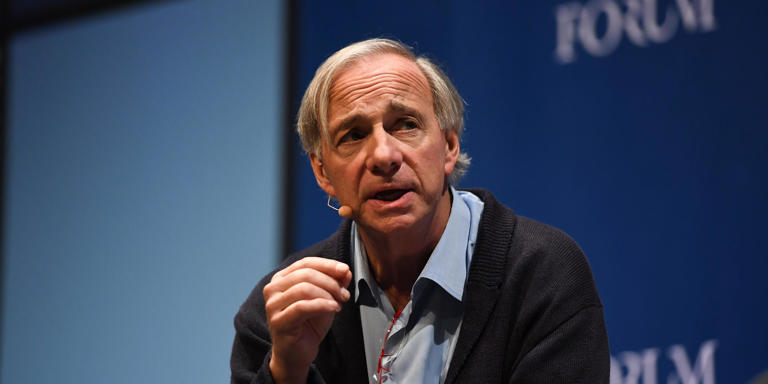

Ray Dalio, the founder of Bridgewater, recently shared his views on the state of the stock market, indicating that he does not believe it resembles a bubble. In a new note, the renowned hedge fund investor outlined his criteria for identifying a market bubble, including high prices relative to value, signs of unsustainable growth, and speculative behavior driven by debt. Dalio observed that when applying these criteria to the US stock market, including its most highly publicized sectors, he does not see evidence of a full-fledged bubble.

While the S&P 500 has been setting records in 2024 and posting significant gains, Dalio pointed out that the so-called “Magnificent Seven” stocks—Apple, Amazon, Tesla, Nvidia, Microsoft, Alphabet, and Meta—have been particularly notable contributors to market performance. However, he noted that despite the attention these stocks have garnered and their substantial increase in market capitalization since January 2023, they do not exhibit the characteristics of a bubble.

Dalio acknowledged that valuations for the Magnificent Seven stocks may be slightly expensive relative to current and projected earnings, and sentiment surrounding them may be bullish. Nevertheless, he emphasized that there is not an excessive level of leverage or an influx of inexperienced investors driving their prices.

Supporting Dalio’s assessment, recent surveys from Bank of America and Charles Schwab have shown elevated levels of bullish sentiment among investors. However, despite this optimism, Dalio maintains that the market does not appear to be in a state of excessive speculation or irrational exuberance akin to a bubble.

Dalio emphasized that despite his assessment of the stock market, there remains the possibility of a significant correction in certain stocks, particularly those related to generative AI, if they fail to deliver on the expected impact.

Nevertheless, historical trends support the notion that stocks are not currently in a bubble. DataTrek Research cofounders Nicholas Colas and Jessica Rabe highlighted the S&P 500’s 31% three-year gain on a price return basis, which falls below the typical returns observed before market bubbles and subsequent crashes.

According to the researchers, this data suggests that investor confidence has not reached an unhealthy extreme, alleviating concerns about the existence of a stock market bubble. While this does not guarantee continued gains, it indicates that the risk of a bubble is not currently a pressing concern for the market.