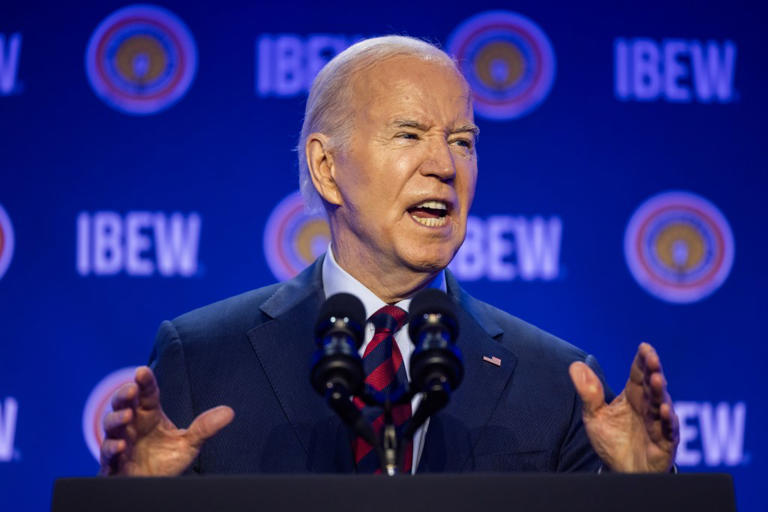

President Biden’s recent remarks regarding the future of former President Donald Trump’s 2017 tax cuts have ignited a significant debate over tax policy and its implications for American society. Speaking at an event attended by electrical union members in Washington, Biden, at the age of 81, delivered a scathing critique of the Tax Cuts and Jobs Act (TCJA), a cornerstone of Trump’s presidency. At the heart of Biden’s criticism was the TCJA’s permanent reduction of corporate tax rates from the previous 35% to the current 21%, as well as its temporary cuts to personal income tax rates, set to expire by 2025. He argued that these measures overwhelmingly favored the wealthiest individuals and large corporations, exacerbating income inequality and contributing to a ballooning federal debt.

Biden’s speech took aim at what he characterized as a policy designed to benefit the rich at the expense of the middle class and low-income Americans. He emphasized the need to address what he saw as the unfairness inherent in the TCJA, asserting that if re-elected, he would allow the Trump-era tax cuts to expire and remain expired. This declaration, though seemingly spontaneous, was later clarified by administration officials, who stated that it aligned with Biden’s broader budget proposal. This proposal seeks to let the tax cuts for corporations and high-income earners—defined as those making over $400,000—expire, while extending tax cuts for individuals and families earning less.

However, the potential consequences of allowing the Trump tax cuts to expire have sparked significant concern and analysis, particularly regarding their impact on different income brackets. According to the Tax Foundation, a nonpartisan think tank specializing in tax policy research, the expiration of these cuts would likely lead to tax increases across the board. Their analysis suggests that individuals and families, regardless of income level, could face higher tax burdens if the TCJA provisions are not extended. Notably, higher-income households would be disproportionately affected, facing substantial hikes in their tax liabilities.

The Tax Foundation’s research also sheds light on the distribution of tax cuts under the TCJA, revealing a complex picture of benefits and disparities. While the cuts provided relief for various income groups, including middle-income and lower-income individuals, they disproportionately favored the wealthiest earners. Democrats have pointed to this unequal distribution of benefits, arguing that the tax cuts primarily served to enrich the already affluent. They contend that higher-income individuals, due to their larger tax liabilities, received the lion’s share of the tax reductions, exacerbating income inequality.

Biden’s statements and the subsequent debate underscore the broader conversation surrounding tax policy in the United States. Supporters of Biden’s stance advocate for a fairer tax system that prioritizes the needs of the middle class and working families, while critics warn against the potential economic ramifications of higher taxes, particularly for businesses and high-income earners. As policymakers and analysts continue to grapple with these issues, the future of tax policy in America remains a subject of intense scrutiny and debate, with far-reaching implications for the nation’s economic prosperity and social equity.