Federal Reserve Chairman Jerome Powell’s recent remarks regarding inflation and economic growth shed light on the current economic landscape, particularly in the context of the Fed’s monetary policy stance. Powell acknowledged a stagnation in progress toward the Fed’s 2% inflation target since the outset of 2024. Despite robust economic expansion and a resilient labor market, inflationary pressures have persisted, prompting the central bank to consider maintaining interest rates at their current level for a more extended period than previously anticipated.

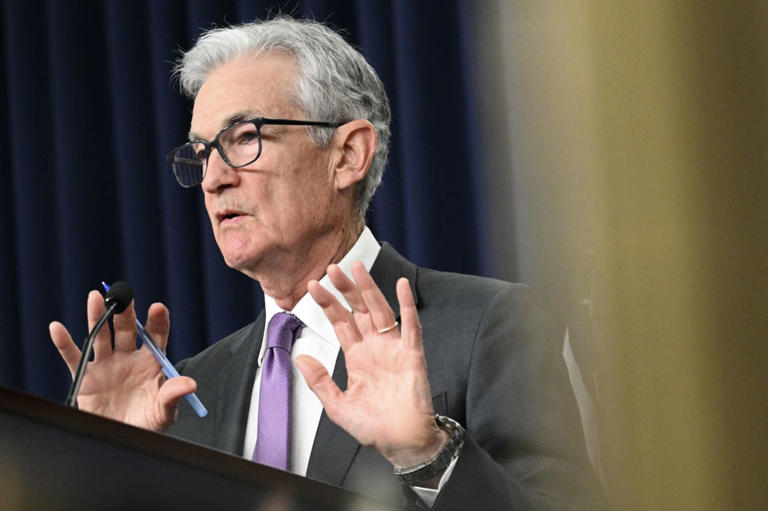

Powell’s comments were delivered during a discussion with Bank of Canada Governor Tiff Macklem at the Wilson Center in Washington, D.C. It marked Powell’s first public appearance since early April, coinciding with a period of heightened volatility in financial markets due to inflation concerns. Powell acknowledged the recent trend of inflation data surpassing expectations, prompting a reassessment of market expectations regarding the trajectory of interest rates.

The reaction in the bond market was notable, with bond yields rising and prices falling in response to Powell’s remarks. The yield on the 2-year U.S. Treasury note increased to 4.99%, while the 10-year yield reached 4.66%, its highest level since early November. Stock indexes exhibited volatility, initially declining before recovering later in the trading session.

Powell stressed the importance of patience and vigilance in assessing the inflationary environment, noting that recent data had not bolstered the Fed’s confidence in its inflation outlook. He emphasized the Fed’s commitment to maintaining its current monetary policy stance until there is clear evidence of sustained progress toward the inflation target.

Despite persistent inflationary pressures, Powell expressed confidence in the Fed’s ability to respond effectively to evolving economic conditions. The central bank has refrained from adjusting its federal-funds rate target range since July 2023, providing flexibility to address any unforeseen developments in the labor market or inflation dynamics.

Looking ahead, market expectations for future Fed actions remain uncertain, with futures-market pricing suggesting a low probability of rate adjustments at upcoming Federal Open Market Committee meetings. Powell’s cautious tone reflects the Fed’s data-dependent approach to monetary policy, underscoring the importance of data-driven assessments in shaping policy decisions.

In conclusion, Powell’s remarks underscore the challenges posed by persistent inflationary pressures and the Fed’s commitment to navigating them prudently. The central bank remains focused on achieving its dual mandate of price stability and maximum employment, with interest rate decisions guided by a careful evaluation of economic data and developments.