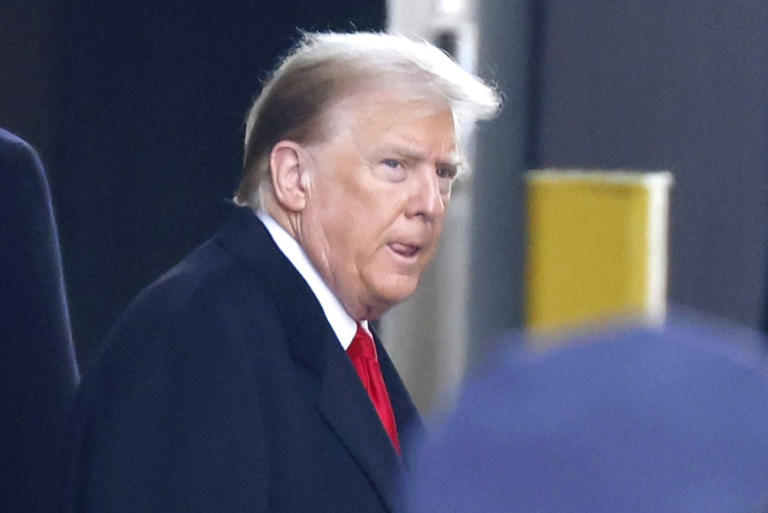

Former President Donald Trump’s foray into the media landscape with Truth Social grabbed headlines as the company made its highly anticipated debut on the Nasdaq stock exchange. Led by former California Republican Representative Devin Nunes, Trump Media & Technology Group, trading under the ticker symbol DJT, saw its stock surge by approximately 50% shortly after the opening bell on Tuesday. The market response reflected considerable investor interest in the controversial media venture.

The culmination of Truth Social’s merger with Digital World Acquisition Corp., a special purpose acquisition company (SPAC), paved the way for its public listing. As per filings with the Securities and Exchange Commission, Trump is positioned to hold a significant ownership stake of at least 58% in the newly formed entity. However, stringent restrictions govern Trump’s access to the company’s assets, which were initially valued at a substantial $3 billion.

The meteoric rise of Truth Social’s stock on its first day of trading fueled speculation about its potential implications beyond the media realm. Analysts and market observers speculated that Trump might leverage the company’s newfound financial clout to address legal matters, including a recent civil fraud judgment against him. This judgment, reduced from $464 million to $175 million, has prompted conjecture that Trump could explore utilizing Truth Social for a stock buyout to help settle the outstanding legal obligation.

The buzz surrounding Truth Social’s market debut harkens back to Trump’s earlier ventures in the corporate world. Notably, in 1995, Trump Hotels Casinos & Resorts made a splash with its initial public offering, also trading under the DJT initials. However, the company faced financial turbulence over the years and ultimately filed for bankruptcy in 2004, underscoring the volatility and risks inherent in Trump-associated enterprises.

While the initial surge in Truth Social’s stock price generated excitement among investors, it also underscored the broader fascination with Trump’s post-presidential endeavors and the intersection of politics, media, and finance. As the company navigates its trajectory in the media landscape, observers will closely monitor its performance and any potential strategic moves, especially in light of its founder’s ongoing legal battles and political ambitions.