Liz Ann Sonders, the Chief Investment Strategist at Charles Schwab, recently drew attention to an intriguing shift in the correlation between Nvidia Corp. (NASDAQ: NVDA) and the broader S&P 500 index. During a segment on CNBC’s “Last Call,” Sonders pointed out a notable decline in Nvidia’s correlation with the S&P 500, dropping from 0.95 at the year’s outset to a significantly lower 0.3.

This divergence suggests that Nvidia’s performance is increasingly marching to the beat of its own drum, rather than moving in lockstep with the broader market. Sonders emphasized that while this shift in correlation is noteworthy, it’s essential to recognize that broader market dynamics are also at play, indicating a broader rotation or correction across various stocks beyond just Nvidia.

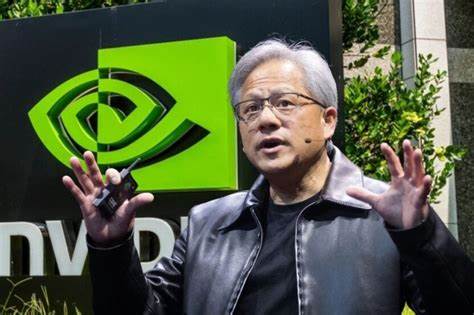

Sonders’ observations come at a particularly interesting time, following Nvidia CEO Jensen Huang’s keynote address at Computex 2024. During this keynote, Huang credited Nvidia’s partners in Taiwan for their pivotal role in shaping the global AI infrastructure. He underscored the critical importance of technologies such as computer graphics, simulations, and artificial intelligence to Nvidia’s strategic vision and continued growth trajectory.

In response to Huang’s address, analysts have highlighted Nvidia’s enduring significance within the computing industry. Goldman Sachs analyst Toshiya Hari, for instance, reiterated a Buy rating on Nvidia shares and set a price target of $1,200. Hari noted the exponential growth in data and computation requirements, particularly in data centers, which has driven robust demand for Nvidia’s products despite concerns about increasing power consumption.

This broader recognition of Nvidia’s importance and the unique market dynamics surrounding the company contribute to the evolving narrative of its performance within the stock market. As Nvidia continues to navigate these dynamics and carve out its path, investors are closely watching for signals of its future trajectory and potential impact on broader market trends.

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari. Benzinga does not provide investment advice. All rights reserved.