NVIDIA Corp (NASDAQ:NVDA) recently achieved a significant milestone by surpassing a market capitalization of $3 trillion, briefly overtaking Microsoft in valuation. This financial accomplishment underscores NVIDIA’s prominence in the technology sector, particularly in the realm of graphics processing units (GPUs) and artificial intelligence (AI) technologies. However, despite its soaring market value, NVIDIA faces challenges in brand recognition that have not aligned with its financial success.

According to a report by Interbrand, a leading brand consultancy firm, NVIDIA does not feature among the top 100 most iconic global brands. This ranking is dominated by household names such as McDonald’s, Starbucks, Disney, and Netflix. Greg Silverman, Interbrand’s global director of brand economics, pointed out that while NVIDIA has rapidly grown its valuation through technological innovation and market dominance, it has not yet focused extensively on building a recognizable brand identity outside of specialized tech circles.

NVIDIA’s remarkable growth in market valuation, which has seen its stock price surge nearly eight-fold since the end of 2022, is primarily driven by the increasing demand for its GPUs. These processors are integral to the AI boom, powering applications across gaming, data centers, autonomous vehicles, and healthcare sectors. Despite its critical role in advancing AI technology, NVIDIA’s brand recognition on Main Street (consumer market) significantly lags behind its reputation on Wall Street (financial markets).

Marc Glovsky, senior brand strategist at Kantar, highlighted NVIDIA’s growing significance among business-to-business (B2B) buyers who make substantial corporate investments, akin to Apple’s influence among individual consumers purchasing iPads and Macs. This shift underscores NVIDIA’s evolving role as a pivotal player in corporate technology infrastructure, even as its consumer-facing brand appeal remains underdeveloped compared to tech giants like Apple, Microsoft, Amazon, and Google.

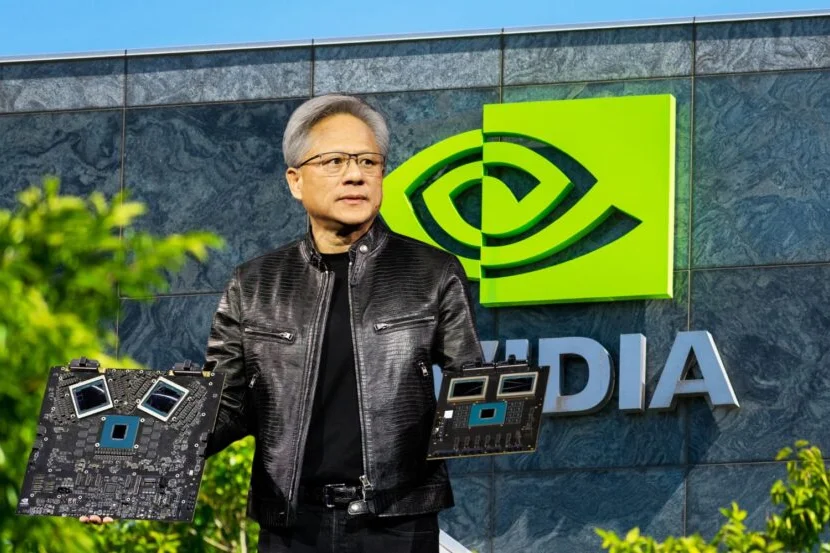

NVIDIA’s ascent to a $3 trillion market capitalization symbolizes its transformation from a specialized hardware manufacturer into a global leader in AI-driven technologies. This transformation has positioned NVIDIA at the forefront of innovation, driving advancements in AI algorithms and computing capabilities that are reshaping industries worldwide.

However, recent market actions by NVIDIA’s CEO, Jensen Huang, have raised eyebrows among investors. Huang sold over $90 million worth of NVIDIA shares amidst concerns about the company’s future earnings potential. Veteran tech investor Paul Wick has voiced skepticism about NVIDIA’s growth prospects, citing uncertainties in the tech sector’s trajectory and market dynamics.

In contrast, Masayoshi Son, founder of SoftBank Group, publicly expressed regret over SoftBank’s decision to sell its stake in NVIDIA earlier, which resulted in missing out on potential windfall gains amounting to $157 billion. Son’s comments underscore NVIDIA’s enduring value and potential in the rapidly evolving technology landscape, despite fluctuations in market sentiment and investor reactions.

As of the latest trading session, NVIDIA’s shares closed at $126.57, reflecting a 3.22% decline amid broader market volatility and investor caution. The company continues to navigate challenges in enhancing its brand visibility and market perception while capitalizing on its leadership in AI and GPU technologies.

In conclusion, NVIDIA’s journey to surpass $3 trillion in market capitalization highlights its pivotal role in driving technological advancements, yet it grapples with the imperative of bolstering its brand recognition to align with its market valuation and leadership position in the AI revolution.