Nvidia’s stock saw an uptick on Friday following the conclusion of its GTC developer event, where the chip maker made significant announcements that garnered praise from Wall Street analysts. However, the market appears to be awaiting indications of further growth, particularly from international markets.

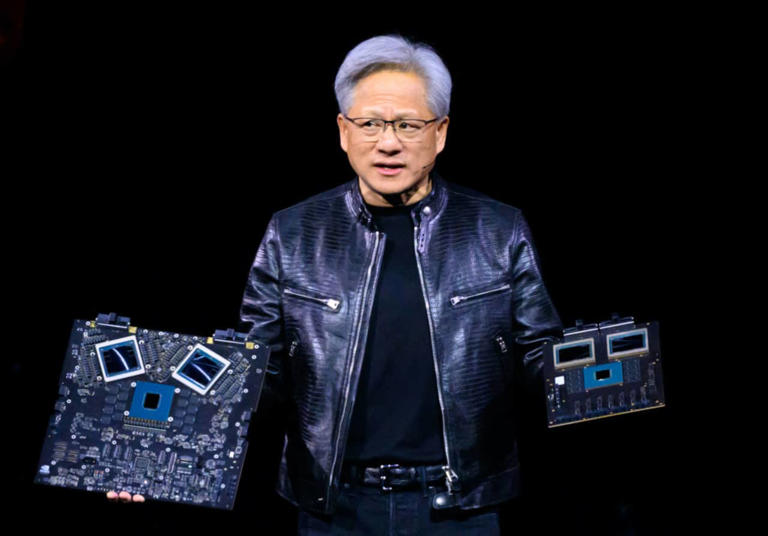

As of Friday, Nvidia shares were up by 1.4% to $927.12. The previous day, the stock had closed up 1.2% at $914.35, representing a modest increase of just over 4% over the duration of the developer event. During the event, Nvidia unveiled its new range of Blackwell chips, generating anticipation among investors and analysts alike.

Wall Street analysts continued to assess the impact of Nvidia’s announcements, with updates still emerging at the end of the week. UBS analyst Timothy Arcuri, for instance, raised his target price on Nvidia’s stock to $1,100 from $800, while maintaining a Buy rating.

Arcuri highlighted the potential for Nvidia to tap into a new wave of demand from global enterprises and sovereigns following the Blackwell launch. He noted that each sovereign could represent a significant market opportunity, comparable in size to a large U.S. cloud customer. Nvidia CEO Jensen Huang has emphasized the necessity for each country to develop its own artificial intelligence infrastructure, which would contribute to the company’s sustained growth even if U.S. technology firms reduce their hardware purchases from Nvidia.

UBS’s Arcuri also suggested that any near-term weakness in Nvidia’s stock could present an attractive buying opportunity, with the expectation of further revenue growth materializing by 2025.

In comparison to other chip makers, Advanced Micro Devices (AMD) experienced a 1.7% decline in its stock price on Friday, while Intel saw a 0.3% decrease.

Nvidia’s shares have performed impressively throughout the year, surging by 85% through Thursday’s close. This substantial increase far outpaces the gains seen in broader market indices such as the S&P 500 and the Nasdaq Composite, which recorded increases of 9.9% and 9.3%, respectively, over the same period.