This week, Nvidia Corporation’s stock led a notable sell-off among major technology companies focused on artificial intelligence (AI). Nvidia, a pivotal player in the AI space, saw its shares drop nearly 7% on Wednesday after a modest gain earlier in the week. This decline followed a series of earnings reports from key tech giants, collectively known as the “Magnificent Seven,” which revealed financial results that unsettled investors.

Earnings Reports and Market Reactions

Tesla and Alphabet (Google’s parent company) released their financial results on Tuesday, setting the stage for market reactions that rippled through the tech sector.

- Tesla: The electric vehicle (EV) manufacturer reported a dramatic 45% decrease in net income compared to the same quarter last year. This significant drop in profitability, coupled with broader market and political uncertainties, led to a noticeable decline in Tesla’s stock price. Investors typically react negatively to such sharp declines in earnings, which in turn impacts the stock’s overall performance. The sharp decrease in net income raises concerns about the company’s financial health and future profitability, contributing to investor anxiety.

- Alphabet: Although Alphabet reported an earnings per share (EPS) of $1.89, surpassing analysts’ expectations of $1.84, the stock faced a downturn the following day. Initially, Alphabet’s shares rose in after-hours trading, but the enthusiasm waned as investors delved deeper into the earnings report. Concerns emerged about slower-than-expected growth in YouTube advertising revenue and a significant increase in quarterly capital spending, which jumped to $13.2 billion—approximately $1 billion more than anticipated. This surge in spending, attributed to Alphabet’s intensified focus on AI, raised questions about the long-term cost-effectiveness and profitability of AI investments.

Broader Impact on the Magnificent Seven

The term “Magnificent Seven” refers to a group of seven leading technology companies that are currently making a significant impact on the stock market. This group includes:

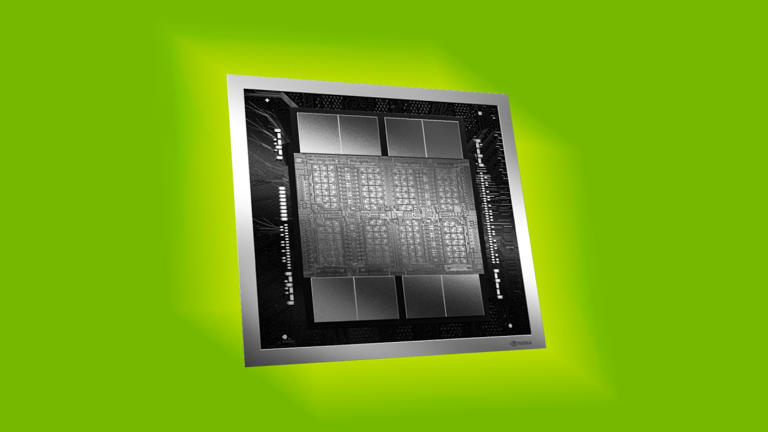

- Nvidia

- Tesla

- Alphabet

- Meta Platforms (formerly Facebook)

- Microsoft

- Apple

- Amazon

Following the earnings reports, a broader sell-off affected these companies:

- Meta Platforms saw a drop of nearly 6% in its stock price.

- Microsoft experienced a decline of 3.59%.

- Apple and Amazon both faced reductions of nearly 3%.

This collective decline among the Magnificent Seven reflects growing investor concerns about the high costs associated with AI development. Despite the substantial investments in AI, there is skepticism about whether these investments will eventually lead to significant financial returns. The fear is that the expenses associated with building and maintaining AI infrastructure may outweigh the potential benefits, leading to a cautious outlook among investors.

Looking Ahead

The week is not yet over, and market sentiment may shift as more earnings reports are released. Key upcoming reports include:

- Microsoft will report its quarterly results on Tuesday.

- Meta Platforms is set to release its earnings on Wednesday.

- Amazon and Apple are scheduled to report on Thursday.

Nvidia’s financial results are expected at the end of August, and their performance will be closely watched by investors. The results will be crucial in determining the future trajectory of Nvidia’s stock and potentially influencing broader market trends related to AI.

Conclusion

The current turbulence among AI-focused tech giants underscores the volatility associated with investing in high-growth sectors. While AI continues to offer significant potential, the substantial costs involved in its development and the mixed signals from recent earnings reports contribute to a cautious investor sentiment. As the earnings season progresses and more results are announced, the direction of these stocks and the overall market outlook on AI investments will become clearer. The coming weeks will be pivotal in shaping investor confidence and determining the future performance of these influential tech companies.