Morgan Stanley’s recent analysis, spearheaded by Michelle Weaver and her team, offers a comprehensive overview of the stocks poised to shine in the upcoming earnings season. Despite the modest growth forecast for first-quarter S&P 500 earnings per share, Weaver and her team express optimism for a sequential recovery in earnings in the second quarter, followed by an expansion in the latter half of the year.

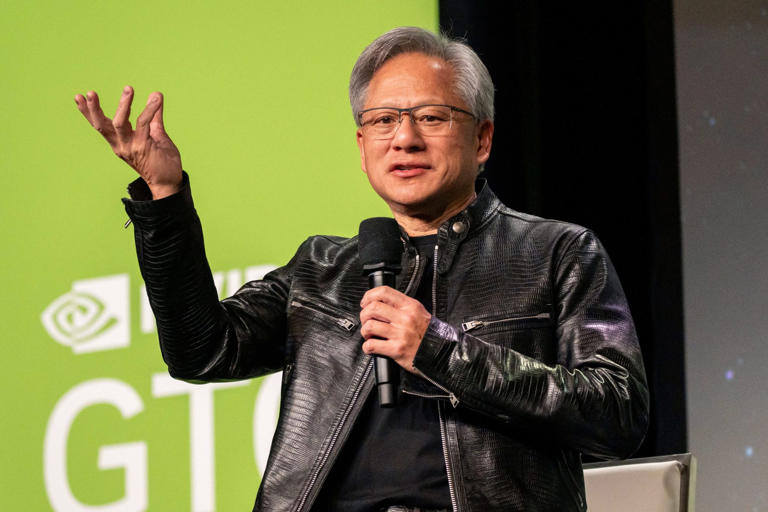

One standout among the highlighted stocks is Nvidia, as identified by Morgan Stanley’s Joseph Moore. Despite its remarkable 200% surge in the past year, Moore maintains a bullish stance, projecting a further 21% increase in Nvidia’s stock price to $1,000 over the next year. Moore points to strong spending trends in artificial intelligence (AI), particularly from key customers like Tesla and sovereign entities, as a driving force behind Nvidia’s continued growth trajectory. Despite concerns regarding Nvidia’s transition to next-generation chips, Moore reassures investors, citing robust underlying demand that dispels fears of a revenue growth pause.

Additionally, Morgan Stanley’s analysts spotlight nine more stocks with buy-equivalent “overweight” ratings, each with near-term catalysts poised to drive significant movement in their share prices.

Abbvie, the pharmaceutical giant, is anticipated to report rising earnings per share figures and potentially positive results from a new schizophrenia drug clinical trial. Amazon, on the other hand, is expected to surpass earnings estimates significantly due to efficiency improvements and cost-cutting measures.

Corning, which produces specialty glass and other materials for scientific applications, is positioned to benefit from higher-than-expected industry-wide LCD panel maker utilization rates. Lazard, the financial service giant, is anticipated to deliver strong profitability fueled by a rebound in M&A activity and a recent C-Corp conversion.

LifeStance Health Group, offering online psychiatry and therapy services, is predicted to continue its solid fundamentals and improving execution. PACCAR, which sells commercial trucks, is expected to maintain performance amid rising tractor orders and the early stages of a commercial vehicle upcycle.

S&P Global, set to beat estimates with strong credit capital markets activity and potential synergies from its merger with IHS Markit, is another stock highlighted by Morgan Stanley. SBA Communications, poised to benefit from strong earnings and the ongoing 5G investment cycle, is expected to see positive movement in its share price.

Lastly, Seagate Technology, likely to exceed earnings forecasts driven by rising hard drive disk production and a cyclical recovery in the data storage market, rounds out the list of stocks poised for potential growth.

Overall, Morgan Stanley’s analysis paints a picture of optimism and opportunity in the upcoming earnings season, offering investors a diverse range of stocks with compelling near-term catalysts for growth and value appreciation.