It seems Nvidia’s remarkable stock performance has enticed several board members to capitalize on the surge by selling off portions of their holdings. Recent SEC filings reveal that over the past four weeks, four insiders at Nvidia have sold significant amounts of company stock, joining a growing trend among executives unloading shares in their respective companies.

Among these board members, Tench Coxe, a former managing director at venture capital firm Sutter Hill Ventures and a long-standing Nvidia board member since 1993, divested $170 million in company stock across three transactions. Coxe, who receives both restricted stock and cash as part of his compensation as a director, opted to sell portions of his holdings amidst the stock’s rally.

Similarly, Mark Stevens, managing partner at S-Cubed Capital and a former partner at Sequoia Capital, sold 12,000 shares worth $10.2 million this week, following a prior sale of 15,000 shares last month totaling $12 million. Stevens, who rejoined Nvidia’s board in 2008 after previously serving from 1993 to 2006, has been actively offloading shares during the recent stock surge.

Another board member, Mark Perry, sold 15,000 shares for approximately $11.9 million shortly after the company’s earnings report on Feb. 21. Perry, a director for nearly a decade and a consultant for nonprofits, has also taken advantage of the stock’s upward momentum to liquidate some of his holdings.

It appears that several prominent figures, including longtime directors at Nvidia such as Harvey Jones, have opted to cash in on a portion of their holdings amid the company’s recent stock surge. Jones, who has been a director since 2003 and serves as managing partner of Square Wave Ventures, sold approximately $53 million worth of Nvidia shares.

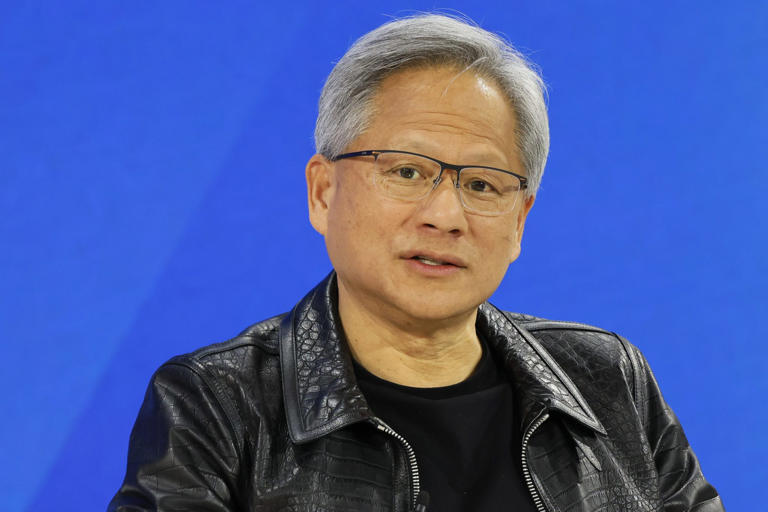

Despite these sales, Coxe, Jones, Stevens, and Perry still retain substantial stakes in the AI chip developer. Coxe holds around 4.1 million shares, Jones holds nearly a million shares, Perry holds 152,000 shares, and Stevens holds 4.4 million shares. CEO Jensen Huang maintains a significant ownership stake, with about 86 million shares, representing a 3.5% ownership interest in the company.

In a similar vein, Amazon CEO Andrew Jassy sold 50,000 shares in Amazon this week for approximately $9 million. Notably, Jassy’s sale was part of a prearranged trading plan, indicating a planned divestiture of shares rather than a reactive move to market conditions.