Paolo Zannoni, the executive deputy chairman of the board of Prada, president of Prada Holding, and advisor to the executive office of Goldman Sachs International, offers a profound exploration into the dynamics of banking in his new book, Money and Promises: Seven Deals That Changed the World. Drawing from his extensive experience in banking and business, Zannoni elucidates why bank failures and subsequent bailouts are inevitable features of the financial ecosystem.

A Historical Perspective on Bank Failures

The headnote on the Wikipedia entry for “List of largest bank failures in the United States” underscores the dynamic and incomplete nature of tracking such failures. Since the 2008 financial crisis, over 500 banks have failed in the U.S., impacting billions of dollars and tens of thousands of jobs. In the past year alone, three major U.S. banks—Silicon Valley Bank, Signature Bank, and First Republic Bank—collapsed, each holding assets exceeding $1 billion. This recurring phenomenon prompts a fundamental question: Why do banks fail repeatedly?

The Nature of Banking

Zannoni posits that the nature of banking itself is inherently linked to its propensity for failure. Throughout history, from medieval and Renaissance Italy to modern times, banks have grown, expanded, and eventually failed. Governments have historically responded with bailouts, attempting to stabilize the financial system and prevent widespread economic fallout. This cycle of growth, failure, and bailout is a fundamental aspect of the banking ecosystem.

The Banking Paradox

At the heart of banking lies a paradox: Banks thrive by converting their clients’ debts into their own, generating income and fueling economic activity. This process benefits consumers, investors, and the state by providing capital, increasing purchasing power, and supporting public goods. However, banks’ reliance on debt makes them inherently fragile. Their drive to take on more debt to generate profit increases their susceptibility to failure.

The Symbiotic Relationship Between Banks and States

Banks and states share a symbiotic relationship. States rely on banks to facilitate economic growth, while banks depend on states for regulatory support and bailouts during crises. This relationship has its pitfalls, as excessive risk-taking by banks can lead to systemic failures. Nevertheless, the state’s intervention through bailouts serves as a safety net, minimizing the adverse effects on investors and society.

The Cycle of Regulation and Deregulation

In response to banking crises, states often implement regulations to fortify the financial system. However, these regulations can stifle economic growth by limiting banks’ ability to provide essential financial services. Over time, this leads to deregulation, which allows banks to expand until the next cycle of failure begins. This perpetual cycle highlights the complexity of balancing economic growth with financial stability.

A Lifelong Banker’s Perspective

Zannoni’s career has given him a front-row seat to the banking of business and the business of banking. His work with governments, corporations, financial institutions, and individuals has provided him with a deep understanding of how banking operates in practice. His scholarly pursuit of the development of banking and monetary systems further enriches his insights.

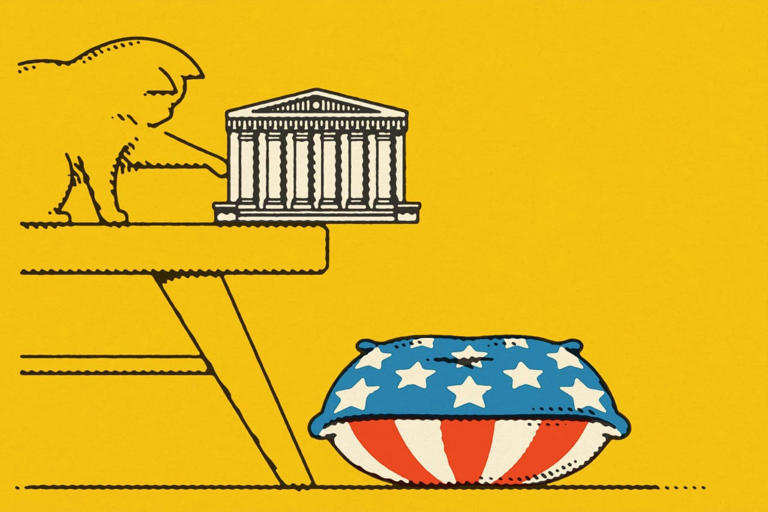

The Inevitability of Bailouts

Zannoni concludes that both bank failures and bailouts are unavoidable. The state’s willingness to bail out banks during crises is a necessary response to the systemic risks inherent in banking. While critics call for sweeping reforms, Zannoni argues that the complexity of banking systems defies easy solutions. Instead, he advocates for informed decision-making and an understanding of the intrinsic link between bankers’ self-interest and societal benefits.

Maintaining a Resilient Banking System

The inevitability of bank failures and the subsequent bailouts illustrate a profound truth about human nature and economic systems. Ambition and greed, while potentially leading to crises, also drive economic progress. Acknowledging and managing this tension is crucial for maintaining a resilient and functional banking system.

In sum, Zannoni’s exploration provides a comprehensive understanding of why bank failures are an inescapable aspect of the financial ecosystem and why bailouts are a necessary, albeit controversial, solution. His insights are crucial for fostering informed decision-making and maintaining a balanced perspective on the cyclical nature of banking.