On Wednesday, the technology sector, especially chip companies, experienced a sharp downturn, signaling a stark reversal from their earlier strong performance this year. The Nasdaq Composite index, heavily weighted with tech stocks, plummeted by 2.6% in late afternoon trading, reflecting widespread selling across the sector and broader market concerns.

Leading the decline was the semiconductor segment, with the iShares Semiconductor ETF plunging by 6.6%. This pronounced drop highlighted investor anxieties driven by a combination of geopolitical tensions and shifting market dynamics.

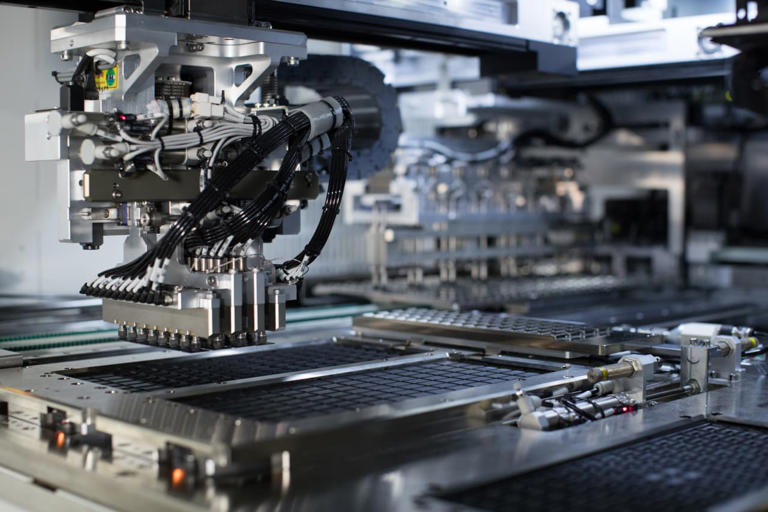

Geopolitically, the tech industry reacted strongly to potential changes in U.S. policy regarding semiconductor exports. Reports suggested that the Biden administration is contemplating stricter controls on the export of chipmaking equipment to China, which could significantly impact companies like ASML Holding. As a result, ASML’s American depositary receipts (ADRs) nosedived by 12%, underscoring fears of disruptions in the global semiconductor supply chain.

Adding to the uncertainty, comments from former U.S. President Donald Trump exacerbated concerns by implying that Taiwan might need to assume a greater responsibility for its own defense in the future. This geopolitical stance raised apprehensions about increased tensions in the region and potential implications for semiconductor manufacturing, particularly affecting Taiwan Semiconductor Manufacturing Company (TSMC), whose ADRs saw a sharp decline of 7.8%.

Investors responded swiftly to these geopolitical uncertainties, which cast doubt on the stability of global semiconductor supply chains and international trade relations crucial for tech companies. The prospect of continued or intensified restrictions under a potential Trump administration return further clouded the outlook for chipmakers reliant on global networks for manufacturing and distribution.

Beyond geopolitical factors, a notable market rotation toward smaller stocks also contributed to the tech sector’s decline. The Russell 2000 index, which tracks small-cap stocks, surged by over 11% in recent trading sessions, indicating a shift in investor sentiment towards perceived safer investments amid broader market volatility.

Market analysts like Jordan Klein from Mizuho Securities suggested that a correction in the semiconductor sector could be beneficial, potentially adjusting overinflated investor sentiment and high valuations. However, companies directly involved in chipmaking equipment bore the brunt of the sell-off, with Applied Materials, KLA, and Lam Research experiencing steep declines exceeding 9%.

Looking ahead, analysts cautioned that ongoing rotations and heightened volatility in the tech sector could prompt further market corrections, particularly if marginally leveraged investors are forced to liquidate positions. The evolving geopolitical landscape, with its potential to disrupt supply chains and trade flows, remains a critical factor likely to influence market dynamics in the near term.

Wednesday’s market movements highlighted the delicate balance between geopolitical tensions, investor sentiment shifts, and the resilience of the technology sector. These complexities underscored the challenges facing investors navigating a volatile global market environment, where strategic foresight and adaptability are crucial to managing risks and capitalizing on opportunities.