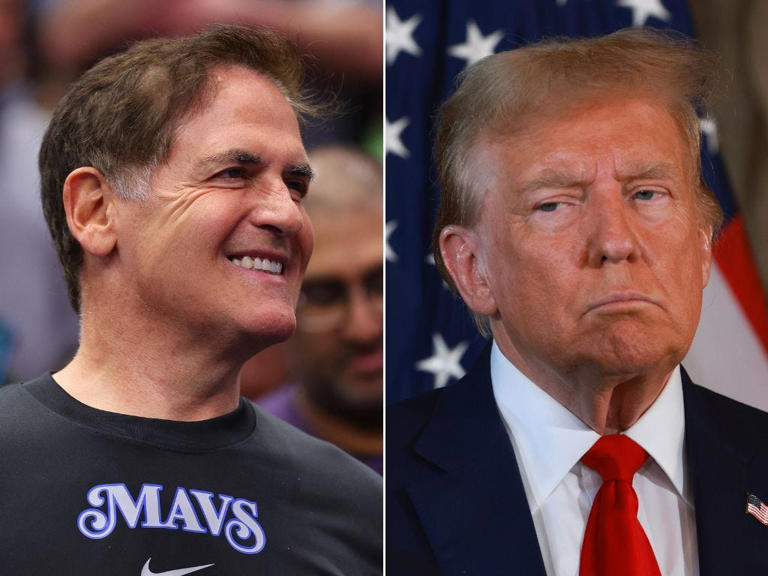

Mark Cuban’s announcement of his $288 million tax payment to the IRS resonated far beyond the realm of financial news, sparking discussions about civic duty, tax transparency, and political commentary. The billionaire entrepreneur’s statement on X not only underscored his commitment to fulfilling his tax obligations but also served as a pointed contrast to the opacity surrounding the tax affairs of certain high-profile figures, notably former President Donald Trump.

Cuban’s declaration, “I pay what I owe,” carried weight beyond its literal financial transaction. It symbolized a principled stance on taxation, reflecting his belief in contributing his fair share to the nation that has afforded him unparalleled opportunities for success. His willingness to publicly disclose the substantial sum he paid to the IRS was a testament to his transparency and accountability, qualities often lacking in the upper echelons of wealth and power.

Moreover, Cuban’s pointed remark about a “former president” who may not share his commitment to tax compliance was widely interpreted as a veiled criticism of Trump. The ongoing feud between the two prominent figures has been marked by public sparring and ideological clashes, with Cuban’s vocal support for President Joe Biden further emphasizing his political leanings.

Beyond the personal animosity between Cuban and Trump, the episode shed light on broader issues surrounding tax fairness and accountability. Trump’s evasiveness regarding his tax returns, coupled with revelations about his minimal tax payments and mounting legal liabilities, has fueled public scrutiny and debate. Cuban’s willingness to pay his taxes openly and proudly served as a stark contrast to the opacity and controversy surrounding Trump’s financial affairs.

Furthermore, Cuban’s $288 million tax payment served as a reminder of the obligations that accompany wealth and influence. It underscored the importance of civic responsibility and the equitable distribution of resources for the betterment of society. In an era marked by growing economic inequality and calls for tax reform, Cuban’s public stance on taxation resonated with many who believe in the importance of wealthy individuals contributing their fair share to support public services and infrastructure.

Overall, Cuban’s announcement sparked widespread discussion about taxation, transparency, and accountability in the highest echelons of society. It highlighted the importance of individuals, especially those with significant wealth, fulfilling their civic duties and contributing to the common good through transparent and responsible tax practices.