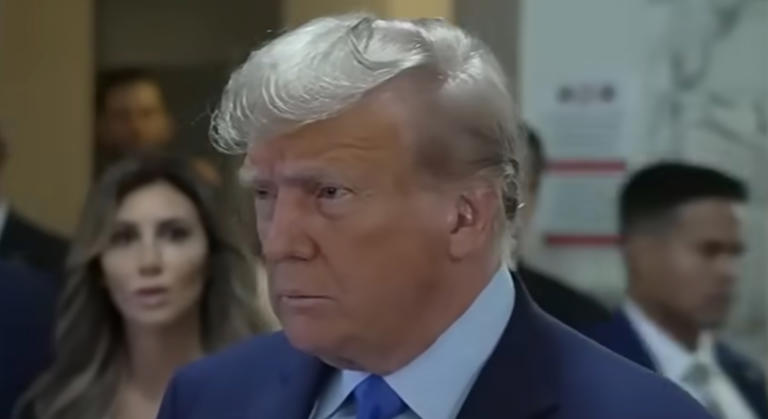

The fallout from former President Trump’s fraud trial has reverberated across the financial sector, prompting a reassessment of investment strategies by real estate mogul Grant Cardone and other industry experts, particularly in New York City.

Cardone, a notable figure in real estate investment, voiced significant concerns regarding the risk-to-reward ratio in New York’s property market following the trial’s outcome. This prompted his firm to cease underwriting activities in the city and redirect their focus to more promising markets such as Texas and Florida, where stability and growth prospects appeared more favorable.

“We thought this year was the opportunity to come into Chicago, California, and New York City. I’ve been waiting for 40 years now to invest in that marketplace. I was completely confident this was the year to come,” Cardone expressed. “And when that ruling happened, it was like, pencils down. Don’t touch it. Don’t go there.”

The aftermath of the trial has cast a shadow of uncertainty over New York’s real estate landscape, with concerns mounting regarding property valuations and the potential for loan defaults. Cardone stressed the critical importance of predictable cash flow for his firm’s investors, citing the unpredictability stemming from the trial’s fallout as a major deterrent to investment in the city.

“Loan proceeds are based on the value of the property. They’re going to require me to actually underwrite my property on the cash flow, the income of the property and what valuation I believe that property’s worth. The broker also put a valuation on it,” he elaborated, shedding light on the complex process of property valuation and lending.

In alignment with Cardone’s sentiments, Kevin O’Leary echoed concerns about the viability of investing in New York post-trial, citing policy issues and high taxes as significant deterrents. O’Leary underscored the necessity for investors to explore alternative markets like Texas, Florida, and Arizona, where conditions for growth and stability were perceived to be more favorable.

Cardone also warned of a potential domino effect in the business community, wherein investors became increasingly wary of committing substantial funds to New York in the foreseeable future. He bemoaned the state’s policy landscape and high tax burdens, drawing parallels to other states like California that face similar challenges.

The consensus among financial experts indicates a shifting tide in the investment landscape, with New York’s real estate market facing formidable obstacles in the wake of the trial’s outcome. As uncertainty looms over the city’s future, alternative markets such as Texas and Florida emerge as attractive destinations for investors seeking stability and opportunity in their investment portfolios.