In the financial saga of 2023, the spotlight shone brightly on the “Magnificent Seven” – a formidable lineup of tech titans including Alphabet, Amazon.com, Apple, Meta Platforms (formerly Facebook), Microsoft, Nvidia, and Tesla. Together, these giants propelled the S&P 500 to remarkable heights, driving a historic 24% surge. Yet, amidst the euphoria of the market rally, concerns began to emerge about the rising dominance of what came to be known as the “Big Three.”

The “Big Three” – comprising Microsoft, Nvidia, and Apple – commanded an unprecedented 20% share of the S&P 500’s total valuation, a level of concentration unseen in the index’s storied history. This concentration sparked apprehension among investors, raising questions about the potential risks associated with such dominance.

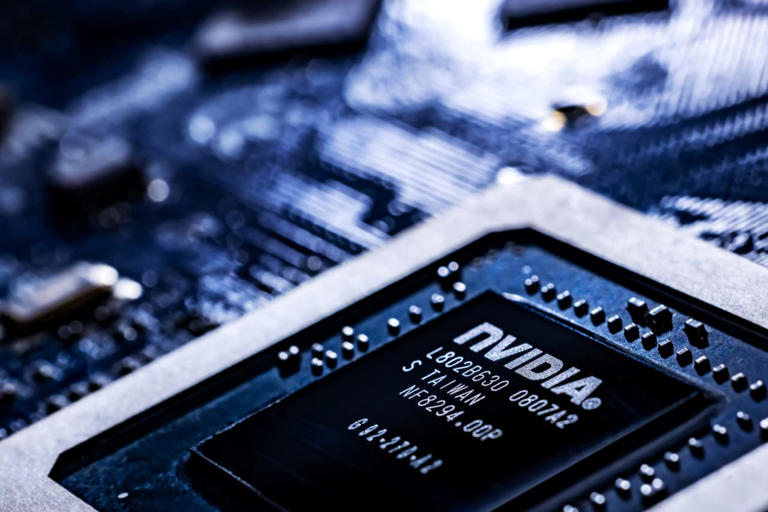

Larry McDonald, the perceptive founder of Bear Traps Report, emphasized the significance of Nvidia’s meteoric ascent. Unlike stalwarts like Microsoft and Apple, Nvidia’s business model was marked by greater volatility, magnifying its impact on the market. McDonald noted how Nvidia’s influence extended beyond its own stock price, exerting a substantial effect on broader market dynamics due to its substantial market capitalization.

Despite concerns over market concentration, some analysts argued that the lofty valuations of these tech behemoths were justified by their robust prospects for value creation. Companies like Nvidia, Microsoft, and Apple consistently delivered impressive economic profits, providing a solid foundation for their market capitalizations.

However, this concentration risk was not without precedent. Historical data showed that, in the past 40 years, the weight of the top 10 components of the S&P 500 typically hovered around the 20% mark. Yet, the current dominance of the “Big Three” represented an unprecedented level of concentration, raising eyebrows and prompting market observers to reassess the balance of power within the index.

In the face of mounting concerns, investors grappled with the implications of this concentration risk. While the dominance of these tech giants may have fueled the market rally, it also heightened the vulnerability of the broader market to disruptions within the technology sector. Moreover, the potential for regulatory scrutiny loomed large, as policymakers scrutinized the market power wielded by these corporate behemoths.

Despite the uncertainties, the success of these tech giants underscored the transformative impact of innovation and technology on the modern economy. As the market landscape continued to evolve, the trajectory of these key players remained a focal point of investor attention and scrutiny. Ultimately, the fortunes of the market would be shaped by the interplay of economic fundamentals, technological innovation, and regulatory dynamics, with the “Big Three” at the center of the unfolding narrative.

For further insights and analysis, investors were encouraged to delve deeper into the market dynamics and consult with industry experts for a comprehensive understanding of the evolving landscape.