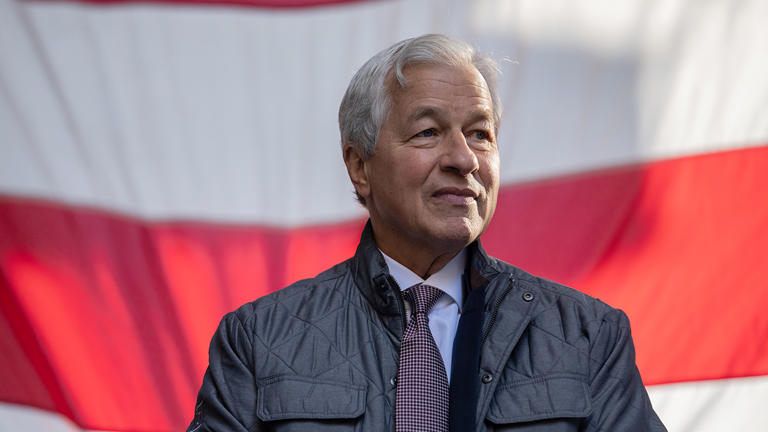

JPMorgan Chase CEO Jamie Dimon noted an improvement in market sentiment for equities and mergers and acquisitions, while maintaining a cautious stance on the overall economy during an interview on Monday.

Dimon observed that confidence is rising, with increased M&A discussions, strengthening equity markets, and open high-yield markets. He acknowledged the elevated levels of the markets and the positive sentiment among investors. However, he also expressed concerns, suggesting doubts about the possibility of a soft landing for the U.S. economy. While market participants are pricing in a 70% to 80% chance of a soft landing, Dimon believes the likelihood is only half of that.

Despite efforts by the Federal Reserve to address high inflation, the U.S. economy has managed to avoid recession thus far. Dimon has previously cautioned about geopolitical tensions, such as Russia’s conflict with Ukraine and the ongoing conflict between Hamas and Israel, which could have repercussions on global growth. He has previously stated that the current period may be one of the most perilous in decades.

Dimon, the CEO of the largest bank in the U.S., welcomed more regulatory scrutiny of private market participants competing with banks for deals.

Dimon also commented on the recent deal where Capital One is set to acquire Discover for $35.3 billion, emphasizing the importance of allowing companies to expand, merge, and innovate.

The proposed merger would result in the formation of the largest U.S. credit card issuer, with $250 billion in card balances and a market share of 22%, surpassing even that of JPMorgan.

“I am not worried about it,” Dimon remarked. Nonetheless, he raised concerns about potential unfair advantages in Capital One’s debit network resulting from the merger.

Dimon highlighted the differing pricing standards for cards offered by banks compared to those from card issuers, stating, “Of course I have a problem with that.”