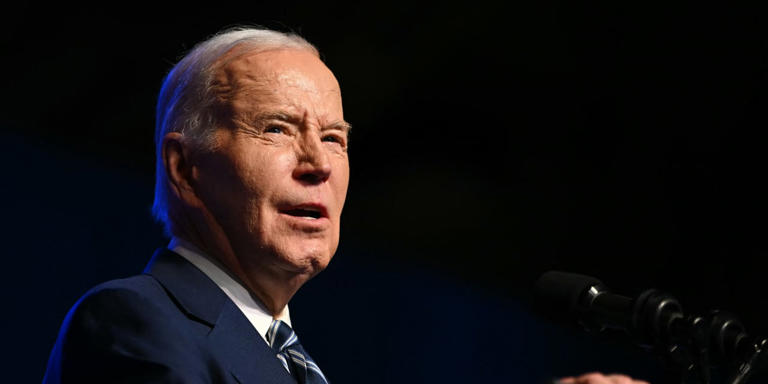

President Joe Biden’s latest budget proposal has sparked significant debate and attention in Washington, particularly given the challenging political landscape of a Republican-controlled House of Representatives. Despite facing formidable obstacles to approval, Biden’s budget serves a strategic purpose as a campaign document for the upcoming presidential election, strategically positioning key policy proposals and highlighting potential areas of contrast with political opponents.

One of the most notable aspects of Biden’s budget, though somewhat obscured in the fine print, is a substantial provision targeting high-net-worth individuals: a proposed 25% tax on unrealized capital gains for those with a net worth exceeding $100 million. While this provision is not guaranteed to become law, its inclusion in the budget sets the stage for a contentious debate around tax policy and income inequality, particularly as it pertains to figures like former President Donald Trump, who has faced scrutiny over his tax practices.

The proposed tax on unrealized capital gains represents a significant departure from traditional tax policy, which typically focuses on taxing income rather than accumulated wealth. By targeting individuals whose wealth is primarily derived from assets rather than income, Biden’s proposal aims to address disparities in the tax treatment of different segments of the population, highlighting broader issues of economic inequality and tax fairness.

While high-income earners often face substantial tax liabilities, individuals with significant asset holdings frequently benefit from preferential tax treatment on their wealth. Biden’s proposal seeks to rectify this imbalance by introducing a minimum tax on total income, including unrealized capital gains, for individuals with wealth exceeding $100 million. This provision underscores the administration’s commitment to addressing income and wealth inequality through targeted tax policy measures.

Although the likelihood of Biden’s tax proposal becoming law remains uncertain, its inclusion in the budget reflects a broader effort to reshape the discourse around tax policy and economic fairness. By pushing the boundaries of acceptable policy discourse and drawing attention to issues of income and wealth inequality, Biden’s budget proposal sets the stage for a robust debate on tax policy and economic justice in the lead-up to the presidential election.

As the election season unfolds, the proposed tax on unrealized capital gains is poised to remain a central point of contention and debate, shaping the broader political narrative and potentially influencing voter perceptions of the respective candidates’ positions on economic issues.