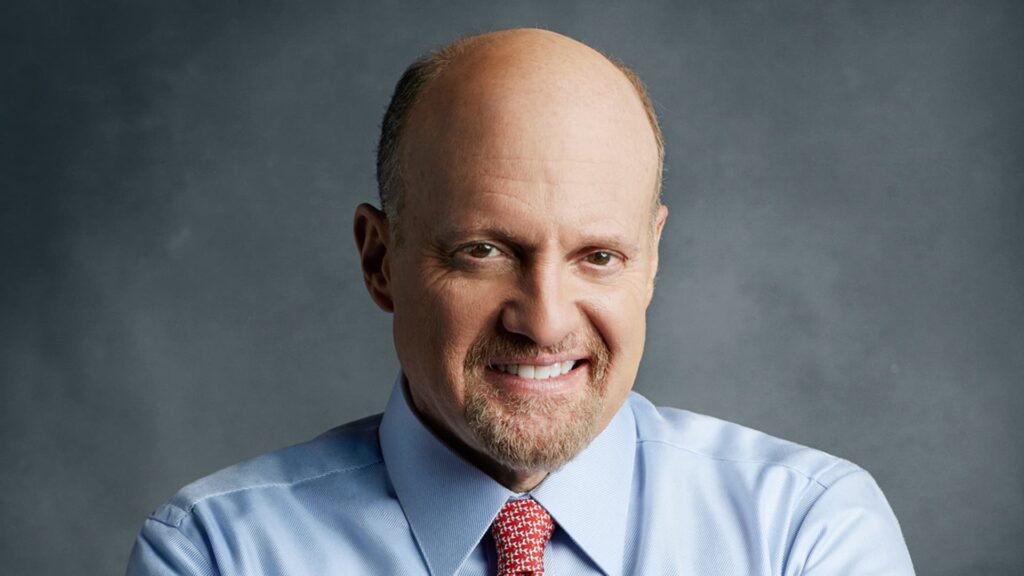

Jim Cramer Recommends “Slowdown Stocks” in the Pet Sector

As the market’s most prominent stocks begin to lose momentum, CNBC’s Jim Cramer suggests a strategic pivot for investors: consider “slowdown stocks,” particularly those related to the pet industry. During Tuesday’s segment, Cramer emphasized the potential of companies like Chewy, Elanco, and J.M. Smucker, which offer products and services catering to pet owners. According to Cramer, these companies are poised to benefit from enduring market trends that can provide stability and growth even in a sluggish economy.

Chewy: Online Pet Retailer on the Rise

Chewy, the online retailer specializing in pet products, has shown a remarkable rebound over the past few months. This resurgence has been fueled by strong earnings reports and positive trends in pet adoption. Cramer highlighted that Chewy’s recent quarterly report was a “gamechanger,” demonstrating significant earnings growth and optimistic commentary from the company’s management. The uptick in pet ownership, driven by ongoing trends, has contributed to Chewy’s success. Cramer believes this secular trend can thrive regardless of broader economic conditions, making Chewy a compelling investment.

Elanco: Innovations in Animal Healthcare

Elanco, an animal health care company that originated as a spin-off from pharmaceutical giant Eli Lilly, has also caught Cramer’s eye. The company boasts a promising pipeline of innovative treatments. For instance, Elanco is developing a drug for canine parvovirus, a condition that can be fatal for dogs lacking regular vaccinations. Additionally, Elanco is working on a pill treatment for cats with diabetes. Cramer pointed to the company’s strong earnings report in early May, which has since driven a significant rise in its stock price. This increase reflects investor confidence in Elanco’s future prospects and its potential to address critical needs in animal health care.

J.M. Smucker: A Defensive Play with Growth Potential

J.M. Smucker, a company well-known for its namesake jelly products and a variety of snacks, also has a substantial presence in the pet food market. While the company’s stock has faced some volatility recently, partly due to investor concerns over the impact of weight loss drugs on its snack food brands, Cramer remains optimistic about its potential. He noted that the pet food sector’s sales were higher than those of the sweet baked snacks segment in the last quarter. Cramer praised J.M. Smucker’s efforts to streamline its pet food portfolio, which he sees as part of a “shrink-to-grow-more-profitably” strategy. This approach could help the company capitalize on the growing pet market while mitigating risks associated with its snack food brands.

Market Trends and Defensive Investments

Cramer underscored the importance of investing in sectors with resilient, secular trends during tougher market conditions. He believes the pet industry fits this criterion well, offering both stability and growth potential. “In a tougher market, we need secular trends that can triumph in any economy,” Cramer explained. He sees J.M. Smucker as a particularly appealing investment due to its strong defensive characteristics and its strategic focus on the lucrative pet food market.

Conclusion

Jim Cramer’s endorsement of Chewy, Elanco, and J.M. Smucker reflects his belief in the enduring strength and potential of the pet industry. With strong earnings, innovative treatments, and strategic adjustments to their portfolios, these companies are well-positioned to succeed even as other market sectors slow down. For investors looking to navigate uncertain market conditions, these “slowdown stocks” offer a promising opportunity to achieve both stability and growth.

For more insights and detailed analysis from Jim Cramer, including his latest market moves and investment strategies, consider joining the CNBC Investing Club.