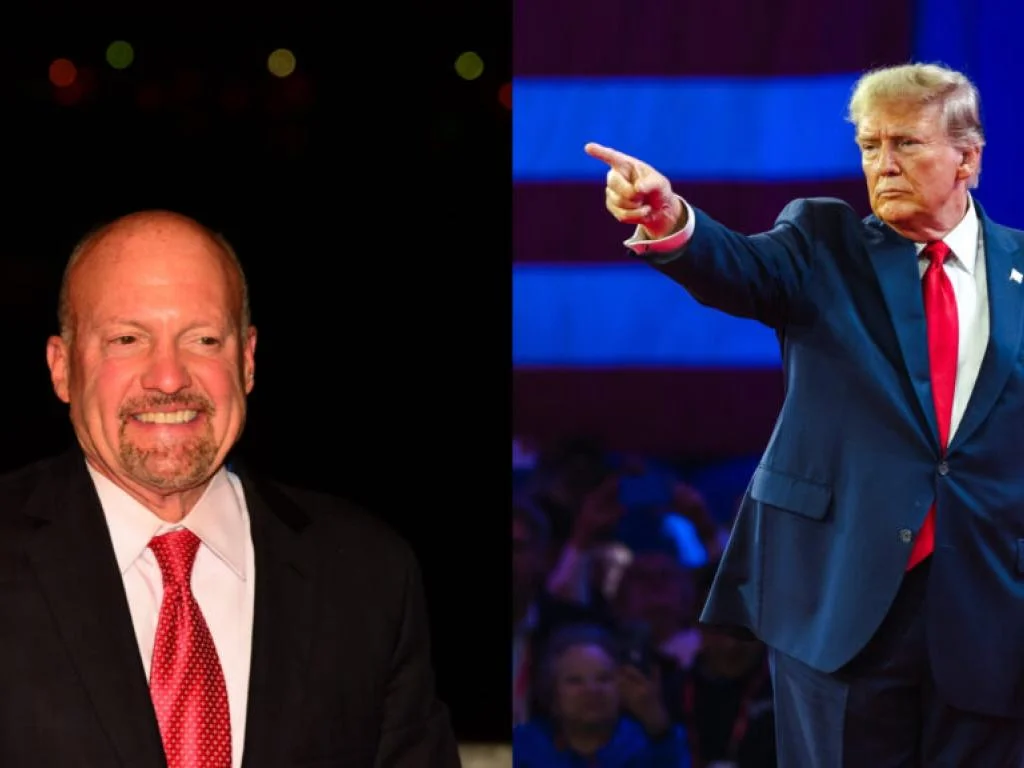

Jim Cramer, a prominent figure on CNBC, recently delved into the potential impact of a return by former President Donald Trump to the White House on various stocks, highlighting both potential gains and risks in the market. Cramer’s observations come amid a backdrop of renewed interest in so-called “Trump stocks,” companies thought to benefit from policies and economic conditions likely under a Trump administration.

Cramer prefaced his analysis by acknowledging the inherent unpredictability of Trump’s influence on markets, noting that while certain companies align closely with Trump’s policies, many others operate independently of political affiliations. His cautionary tone underscored the complexity of predicting market reactions to political shifts, emphasizing the need for investors to remain agile and responsive.

The catalyst for Cramer’s assessment was recent political developments, including an assassination attempt, which he suggested may bolster Trump’s electoral prospects against incumbent President Joe Biden. This perception was reflected in market behavior on Monday, with investors favoring stocks anticipated to thrive under a Republican administration.

Key among Cramer’s insights was the expectation of a more lenient regulatory environment for mergers and acquisitions under Trump compared to Biden’s more stringent approach. He pointed to major financial institutions such as JPMorgan, Goldman Sachs, Morgan Stanley, and Bank of America as potential beneficiaries of increased M&A activity. Cramer highlighted specific deals, including potential acquisitions by Kroger and Tapestry, which had faced regulatory scrutiny under the current administration.

Conversely, Cramer cautioned against investments in sectors likely to face headwinds under a resumed Trump presidency, particularly those tied to environmental initiatives. He referenced Trump’s rollback of numerous environmental policies during his previous term, which could impact companies in renewable energy and sustainability sectors. Stocks like Enphase, SolarEdge, Sunrun, and Sunnova, which focus on solar and clean energy solutions, saw declines as investors weighed potential subsidy cuts and regulatory shifts.

Reflecting on the broader market sentiment, Cramer drew parallels to previous politically charged periods, evoking his infamous “Trump stock, Trump stock” soundboard button from earlier years. The resurgence of interest in such stocks underscores market expectations linked to political outcomes and regulatory frameworks.

In conclusion, Cramer’s analysis serves as a reminder of the intricate relationship between political landscapes and market dynamics. His insights provide investors with a framework to assess potential opportunities and risks associated with different presidential administrations, emphasizing the importance of strategic planning and risk management in navigating evolving market conditions.