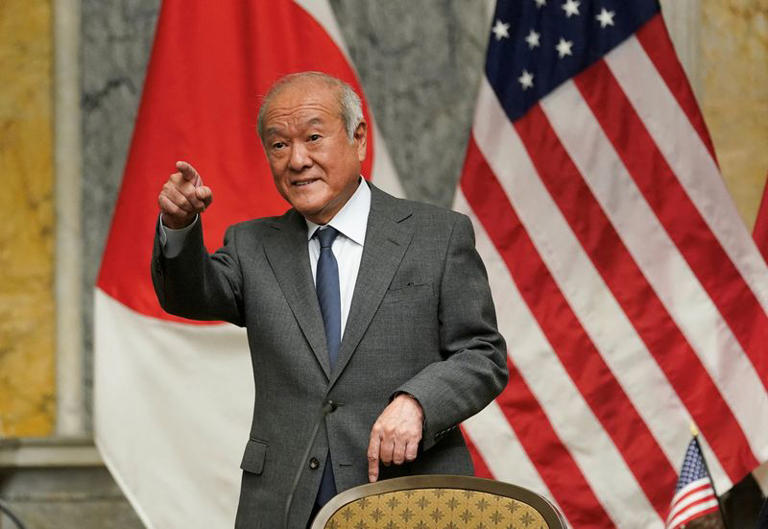

Japan’s Finance Minister Shunichi Suzuki addressed the nation on Friday, offering insights into Japan’s foreign exchange intervention strategy amidst recent market developments. Suzuki’s message underscored the delicate balance between intervention necessity and effectiveness, advocating for a cautious and restrained approach in addressing currency market fluctuations.

Speaking at a regular post-cabinet meeting news conference, Suzuki emphasized the importance of prudence when considering foreign exchange interventions. While acknowledging the potential benefits of such measures in mitigating extreme currency movements, Suzuki cautioned against excessive or unwarranted interventions. He stressed the need for interventions to be conducted judiciously, with careful consideration of their impact and effectiveness in achieving the desired outcomes.

The backdrop for Suzuki’s remarks was the Ministry of Finance’s release of data indicating a significant decline in Japan’s foreign reserves. According to the latest figures, Japan’s foreign reserves stood at $1.23 trillion by the end of May, marking a notable decrease of $47.4 billion compared to the previous month. The decline was primarily attributed to a reduction in holdings of foreign securities, prompting speculation about the composition and utilization of Japan’s reserves.

Analysts, including Ueno Tsuyoshi from NLI Research Institute, interpreted the data as evidence of Japan’s recent interventions in the currency market. Tsuyoshi suggested that Japan likely sold a portion of its U.S. Treasury holdings to finance interventions aimed at selling dollars and purchasing yen. The Ministry of Finance’s data revealed that Japanese authorities expended approximately 9.79 trillion yen (equivalent to approximately $62.85 billion) in interventions, predominantly conducted in late April and early May to support the yen’s valuation.

Suzuki’s cautious stance reflects the challenges inherent in managing foreign exchange interventions. While interventions can help stabilize exchange rates and prevent excessive currency movements, they also carry risks and consequences. Depleting foreign reserves through interventions can impact Japan’s financial stability and economic resilience, necessitating careful consideration of the trade-offs involved.

Furthermore, Suzuki’s remarks come against the backdrop of global economic uncertainties, including the ongoing COVID-19 pandemic and geopolitical tensions. These factors add complexity to Japan’s economic policy decisions, requiring policymakers to navigate a rapidly changing financial landscape while maintaining stability and resilience.

In conclusion, Finance Minister Shunichi Suzuki’s message underscores the importance of a cautious and restrained approach to foreign exchange interventions. While interventions can play a role in managing currency market volatility, Suzuki emphasizes the need for prudence and careful consideration of their impact on Japan’s financial stability. As Japan navigates the challenges of the global economy, policymakers must strike a delicate balance between intervention measures and long-term economic sustainability.