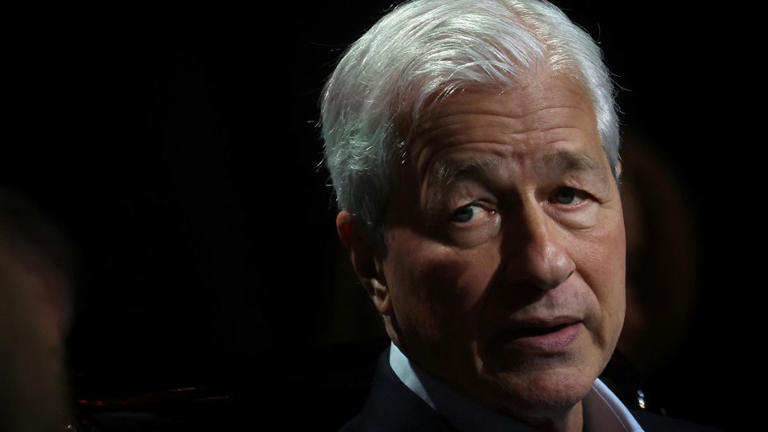

The growing apprehension surrounding America’s burgeoning debt problem has ignited concerns among major business leaders and economists, prompting them to issue stark warnings about the potential consequences. JPMorgan CEO Jamie Dimon recently sounded the alarm, expressing deep-seated fears of an impending crisis, fueled by unchecked deficit spending that could spiral out of control.

Dimon’s cautionary words, delivered in an interview with Sky News, emphasized the critical need for the US government to confront its fiscal deficit issues head-on. He underscored that while borrowing money may stimulate short-term growth, it does not necessarily translate into sustainable economic prosperity. Dimon stressed the imperative for America to prioritize fiscal responsibility, warning that the unchecked deficit is a significant contributor to the nation’s current inflationary pressures.

Echoing Dimon’s concerns, Bridgewater hedge fund founder Ray Dalio also raised red flags about the US debt landscape. Dalio’s warnings underscored the broader consensus among economic experts that investors should be vigilant about the nation’s ballooning debt levels, as they pose significant risks to long-term financial stability.

The sentiments expressed by Dimon and Dalio were further reinforced by economist Glenn Hubbard, who shed light on the growing magnitude of the national debt crisis. Hubbard highlighted the alarming escalation of interest payments on the national debt, which have reached staggering levels comparable to defense spending. This dramatic increase in debt-servicing costs underscores the urgent need for decisive action to address the underlying fiscal challenges.

The root of America’s debt dilemma can be traced back to a combination of factors, including the significant tax cuts enacted during the Trump administration and the unprecedented stimulus measures implemented in response to the Covid-19 pandemic. Despite efforts by the Biden administration to mitigate inflationary pressures through measures like the Inflation Reduction Act, the national debt continues to climb to unprecedented heights.

The current budget deficit, surpassing $855 billion for the fiscal year, paints a grim picture of the nation’s fiscal health. With the deficit representing more than 6% of US gross domestic product (GDP), concerns are mounting over the sustainability of current fiscal policies, particularly against the backdrop of robust economic performance and full employment.

Jason Thomas, head of global research & investment strategy at Carlyle, underscored the inherent dangers of the current deficit level, particularly in anticipation of potential economic downturns. Should the US economy experience a recession, the deficit could skyrocket to unsustainable levels of 9% or 10% of GDP, exacerbating the nation’s fiscal woes.

The ramifications of escalating deficits are profound, spanning across various facets of the economy, from borrowing costs and financial market stability to overall economic growth. As the federal government ramps up issuance of Treasury securities to finance its deficit, borrowing costs inevitably rise, exerting downward pressure on economic growth prospects.

Both the International Monetary Fund (IMF) and the Congressional Budget Office (CBO) have issued stark warnings about the perils posed by the mounting US debt burden. The IMF cautioned that escalating US government debt could precipitate a global surge in borrowing costs, while the CBO highlighted the looming specter of a bond market crisis akin to the one witnessed by the United Kingdom.

Addressing the debt issue demands concerted efforts to rein in deficit spending and implement sustainable fiscal policies. However, the prevailing lack of focus on this critical issue within the current political landscape raises concerns about the timeliness of meaningful action. Without proactive intervention, the US risks facing heightened economic challenges, including elevated borrowing costs and diminished financial stability.