Investors are approaching Nvidia’s annual shareholder meeting with a mix of excitement and trepidation. The company, which has seen an extraordinary surge in its stock price over the past year, has recently experienced a significant downturn. Since Friday, Nvidia has suffered a dramatic $431 billion loss in market capitalization, prompting many to question whether this marks the beginning of a more substantial decline. The situation brings to mind the dot-com bubble of the early 2000s, raising concerns about whether Nvidia might face a similar fate.

The Dot-Com Boom Parallels

Nvidia’s recent rise and subsequent fall bear striking similarities to the story of Cisco Systems during the dot-com boom. In March 2000, Cisco briefly became the world’s most valuable company, only to see its stock value plummet by 80% over the next two years. This decline occurred despite earlier forecasts that Cisco’s hardware was crucial to the future of the internet. Today, Nvidia finds itself in a comparable position. Last week, Nvidia briefly surpassed Microsoft in market capitalization, reaching an impressive $3.34 trillion. Investors had hoped that Nvidia’s hardware would be essential for the future of AI, much like Cisco’s was for the internet.

The AI Boom and Nvidia’s Ascendancy

Nvidia’s recent success is closely tied to the explosion of interest in artificial intelligence, particularly following the release of OpenAI’s ChatGPT in November 2022. This event triggered a generative AI mania that propelled Nvidia’s stock to unprecedented heights. The company’s GPUs are seen as vital components for AI applications, and this perception has been a significant driver of its stock price. High-profile tech leaders such as Sam Altman, Satya Nadella, and Elon Musk regard Nvidia’s chips as essential for advancing AI technologies. As a result, Nvidia reported record quarterly revenue of $26 billion in the first quarter of its fiscal year, a staggering 262% increase from the previous year.

Market Concerns and Investor Sentiment

Despite its impressive financial performance, Nvidia’s rapid rise has sparked concerns among investors and market analysts. The company has significantly influenced the gains of the S&P 500 index this year, raising questions about the sustainability of such growth and the potential risks of having a single stock exert such a large impact. Investors like Peter Bates from T. Rowe Price have expressed unease about Nvidia’s market capitalization, and Manish Kabra from Société Générale has warned of a potential tech bubble forming around AI-related stocks.

Competition and Market Dynamics

Nvidia also faces increasing competition from other companies in the semiconductor industry, notably AMD. Under the leadership of CEO Lisa Su, AMD is intensifying its efforts to produce GPUs that rival Nvidia’s offerings. This growing competition adds to the uncertainty surrounding Nvidia’s future, as shifts in market dynamics can quickly alter the competitive landscape.

Future Outlook and Shareholder Expectations

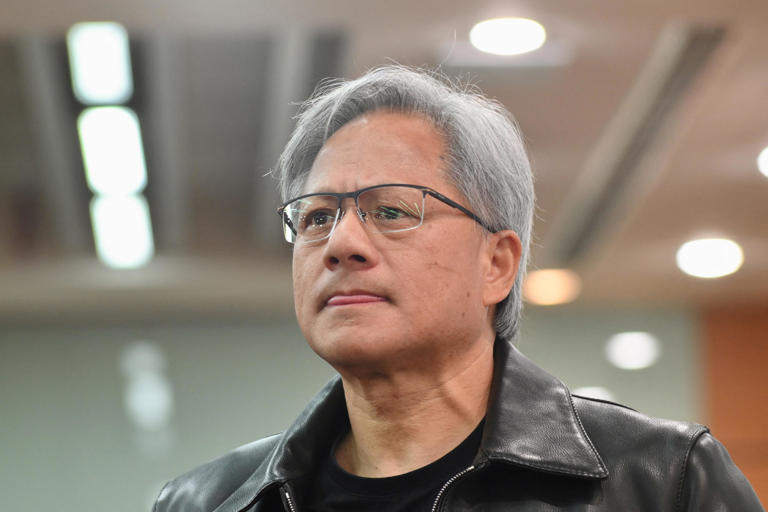

Even with recent losses, some analysts remain optimistic about Nvidia’s long-term prospects. Analysts at Wedbush, including noted Nvidia bull Dan Ives, have predicted that the company could still achieve a market capitalization of $4 trillion, potentially competing with tech giants like Apple and Microsoft. However, the upcoming shareholder meeting will be a crucial moment for Nvidia. CEO Jensen Huang will need to address investor concerns, provide insights into the company’s strategy, and reassure shareholders about its future direction.

Historical Lessons and Investor Concerns

The story of Cisco serves as a cautionary tale for Nvidia investors. More than two decades ago, Cisco was at the pinnacle of the tech world, only to see its value erode dramatically. Today, Cisco is the 64th-most-valuable company globally, a far cry from its heyday. Nvidia’s investors are understandably worried about the potential for history to repeat itself.

As Nvidia navigates these challenging times, the focus will be on its ability to sustain growth amid increasing competition and market skepticism. The shareholder meeting will likely provide critical insights into whether Nvidia’s remarkable trajectory will continue or if the company will face a significant correction. Investors will be looking for reassurances that Nvidia can avoid the pitfalls that befell companies like Cisco and maintain its position at the forefront of the AI revolution.