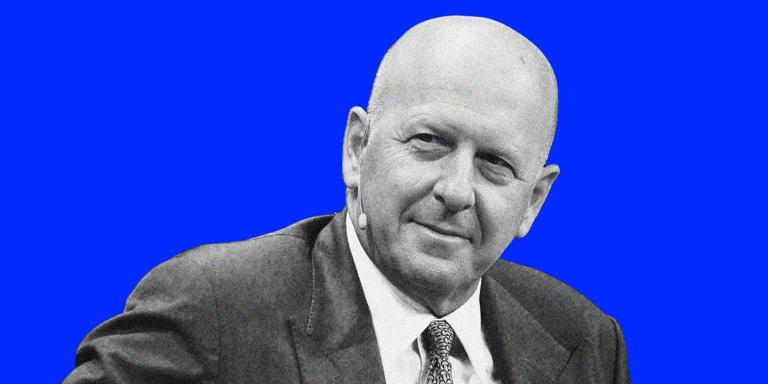

David Solomon, the CEO of Goldman Sachs, recently revised his earlier prediction regarding Federal Reserve interest rate cuts, now forecasting that the Fed might lower rates once or twice later this year. This marks a significant shift from his earlier stance, where he had anticipated no rate cuts for 2024. In an interview on CNBC’s “The Claman Countdown,” Solomon explained that his updated forecast is based on more promising economic data and evolving consumer behaviors influenced by persistent inflationary pressures.

Solomon’s change in perspective reflects a broader reassessment of economic conditions. Earlier in the year, he had been notably cautious about the likelihood of rate reductions. However, recent economic data, including shifts in consumer spending and behavior, have prompted him to adjust his outlook. Specifically, Solomon pointed to changes observed in consumer spending patterns, driven by the high inflation and elevated borrowing costs that have characterized the economic landscape. For instance, recent earnings reports from major companies like McDonald’s have highlighted a slowdown in consumer spending, particularly among lower-income groups who are cutting back on discretionary expenses like dining out due to high prices.

Despite this shift in his forecast, Solomon remains cautious about the immediate impact of potential rate cuts. He expressed skepticism about the extent to which one or two reductions in interest rates would significantly alter the current economic environment. Solomon noted that while lower rates might provide some relief to borrowers and potentially stimulate economic activity, they are unlikely to create a dramatic shift in the overall policy landscape or address deeper economic issues. He emphasized that while the economic environment has been relatively stable, any substantial change would depend on unforeseen shocks or developments.

In contrast to Solomon’s updated forecast, Ian Shepherdson, the founder and chief economist of Pantheon Macroeconomics, has a more pessimistic view of the economic outlook. Shepherdson, who has a track record of accurately predicting economic downturns, anticipates a significant slowdown in the U.S. labor market as early as the second quarter of 2024. He predicts that the Federal Reserve may need to implement up to five rate cuts next year, exceeding the three rate cuts currently anticipated by the market. Shepherdson’s forecast is supported by a range of indicators suggesting weakening economic conditions, including soft retail sales, reduced hiring rates, and increasing layoffs.

Shepherdson’s analysis underscores the potential for a more dramatic economic slowdown, which could necessitate a more aggressive response from the Federal Reserve. He highlighted that a sustained weakening in payrolls and other economic indicators would likely prompt a shift in Fed policy, potentially leading to more significant rate reductions than currently anticipated. Shepherdson’s predictions reflect concerns about the economic impact of ongoing inflation and other factors that could exacerbate financial challenges.

As the Federal Reserve prepares to make key decisions in the coming months, both Solomon’s and Shepherdson’s perspectives underscore the complexity of the current economic situation. Solomon’s revised forecast suggests a cautious optimism about the potential for rate cuts to support economic activity, while Shepherdson’s outlook points to the possibility of a more pronounced slowdown that could drive more aggressive monetary policy adjustments.

In summary, the evolving views of these economic experts highlight the uncertainty surrounding the U.S. economic outlook and the Federal Reserve’s policy decisions. As the Fed navigates these challenging conditions, the interplay between consumer behavior, inflation, and labor market dynamics will be crucial in shaping the future trajectory of monetary policy and overall economic stability.