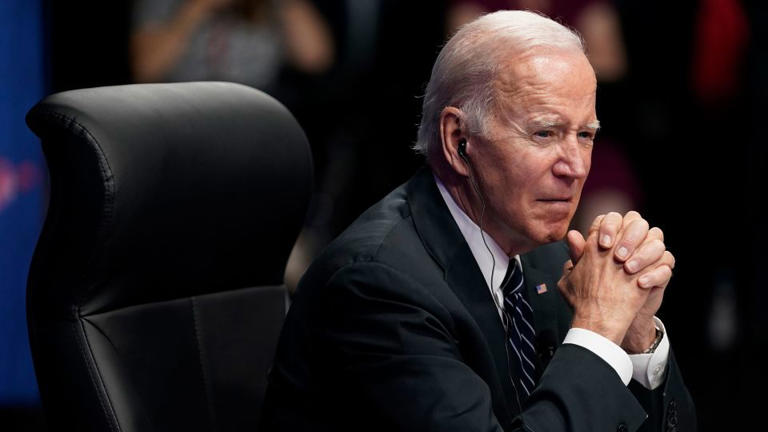

Global markets experienced solid gains after President Joe Biden announced his withdrawal from the 2024 presidential election and endorsed Vice President Kamala Harris as the Democratic nominee. This significant political shift reverberated across various markets, influencing investor sentiment and market dynamics.

In the United States, the Dow Jones Industrial Average ended Monday with a gain of 128 points, or 0.3%, reflecting a positive response to the political development. The S&P 500, a broader measure of the stock market, closed up 1.1%, while the tech-heavy Nasdaq surged by 1.6%. This marked a strong rebound for the US markets, which had been experiencing volatility in recent weeks.

European markets also reacted positively to Biden’s announcement, closing higher as investors welcomed the reduced uncertainty regarding the Democratic nominee. The uplift in European stocks underscored the interconnectedness of global financial markets and the significant influence of US political developments on international investor sentiment.

Asian markets, however, mostly closed lower, indicating a more cautious approach among investors in that region. Despite the overall positive trend in Western markets, the mixed performance in Asia suggested lingering concerns about broader economic conditions and geopolitical factors.

US Treasuries saw a slight increase, leading to trimmed yields. This movement in the bond market reflected a shift towards safer assets amidst the political changes. Meanwhile, the US dollar softened against major currencies, indicating a tempered outlook on the greenback in light of the evolving political landscape.

Tech stocks were among the biggest beneficiaries of Monday’s gains in the US. Nvidia, a leading semiconductor company, saw its shares rise by 4.8%, while Advanced Micro Devices (AMD) gained 2.8%. These gains highlighted renewed investor confidence in the tech sector, which had faced pressure in the preceding days.

Conversely, CrowdStrike, a prominent cybersecurity firm, experienced a significant decline. Its shares plunged by 13.5% following a major global tech outage on Friday. The stock has lost 27% of its value since Thursday, reflecting the impact of operational challenges on investor sentiment.

The endorsement of Kamala Harris by President Biden has substantial implications for the so-called “Trump trades.” Initially, significant doubt about Biden’s ability to defeat former President Donald Trump led investors to buy stocks they believed would benefit from Trump’s tariff-heavy agenda while selling off stocks related to green energy and other sectors potentially adversely affected by Trump’s policies.

Economists have predicted that Trump’s policies could exacerbate America’s inflation problem and increase the US deficit. Recently, as Trump’s prospects seemed to improve, US Treasury prices fell, and yields rose in anticipation of higher inflation. With Harris now becoming the likely Democratic nominee, some of these Trump trades could unwind or at least pause until new polling clarifies Harris’s chances against Trump.

Jay Hatfield, CEO at Infrastructure Capital Advisors, noted that Biden’s endorsement of Harris reduces uncertainty, which could lead to a more muted market reaction compared to what might have occurred if Biden had not endorsed a successor.

Last week was challenging for markets:

- The S&P 500 experienced its worst three-day performance of 2024.

- Europe’s STOXX 600 logged its worst weekly performance since October, as per Deutsche Bank data.

Analysts, such as Deutsche Bank’s Henry Allen, highlighted concerns that market volatility could persist as the election approaches. Historically, the S&P 500 has declined every September since 2020, making it the worst month for the index over the past three years. Despite recent turbulence, the S&P 500 has shown resilience, being higher for 28 out of the last 38 weeks, a streak not seen since 1989.

The political shift with Biden’s exit and Harris’s endorsement has introduced a new dynamic into the markets, reducing some uncertainties while highlighting others. As the election approaches, market participants will closely monitor political developments and their potential impacts on various sectors and the broader economy.